The New York region has one of the strongest economies on the earth, one of the largest and most mature concentrations of financial services, the world’s two largest stock exchanges and an annual economic output greater than that of most countries.[1]

New York City’s economy is not just large, it’s diversified, with concentrations in real estate, design, mass media, fashion, advertising, law, insurance and health care, among other industries. It is the unrivaled economic center of the world’s largest economy.

Now New York City appears to be gaining strength in the one sector where we think of the Bay Area as having a distinct competitive advantage: tech. Silicon Valley might be booming again, but could the next tech boom happen in New York?

Consider the following:

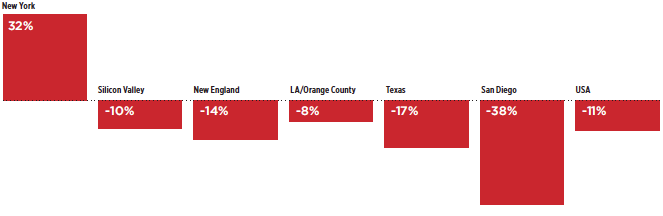

1. Venture capital investment in New York City companies is growing. Over the past five years, the number of venture funding deals made in New York City have shot up 32 percent while venture deals in Silicon Valley have actually decreased by 10 percent.[2] (It should be noted, of course, that by far the largest share of venture funding still goes to the Bay Area — fully 41 percent of the nation’s VC investment.)[3] In fact, of the leading technology regions in the United States, New York City was the only one to see an increase in the number of venture deals between 2007 and 2011. Many of the leading VC firms have opened offices in New York, including New Enterprise Associates, Accel, Bessemer and Union Square Ventures. In 2011, New York passed Boston in its share of venture dollars invested and is now considered the nation’s second leading tech hub by many industry observers.[4]

2. Google opened a New York office in 2006, and in 2010 the company purchased one of New York’s largest buildings, 111 Eighth Street, which has 2.9 million square feet of space — enough room for 11,600 employees. (Today, Google, which does not publicly release its employee data, has somewhere between 15,000 and 20,000 employees in Mountain View.) Many of the established industry giants are increasingly finding it beneficial to grow their businesses in New York, including Amazon, Microsoft, eBay, Facebook and Twitter.

3. The Bloomberg administration has pledged millions to incubators, incentives and new technology programs at Columbia and New York University. In 2011, Mayor Bloomberg launched a major initiative to build a new 2-million-square-foot science and technology graduate campus — NYC Tech — to train thousands of future engineers. The mayor offered $100 million and 12 acres of Roosevelt Island for the project, selecting Cornell University and Technion-Israel University of Technology to build the new campus, which will host an estimated 280 faculty members, 2,500 graduate students and a new U.S. patent office when completed.[5]

What threats does New York pose to the Bay Area’s tech cluster?

It’s not the official economic development strategies like the NYC Tech campus that should worry the Bay Area. More important are the underlying fundamentals supporting New York City’s growth: its ability to attract talent, its urbanity and its existing industry mix.

Growth in Venture Capital Deals by Region, 2007 to 2011

Source: Moneytree Report published by Pricewaterhouse Cooper and the National Venture Capital Association.

Talent

It used to be that people moved in search of work. For at least some segments of the American labor force, the reverse is now true: Companies locate where the necessary talent is. This is the essence of Richard Florida’s “creative class” argument — the locations that attract talent prosper. Cities everywhere are striving to rebrand themselves and improve their offerings in the realms of art, food, nightlife, walkability and cultural tolerance, all the urban amenities that attract the mobile, highly educated workforce that makes it attractive for knowledge-based industries to invest in those communities.

In the global competition for talent, New York City has a great advantage as the world’s leading place for many of these amenities.

Urbanity

SPUR has made the case that there is a strong link between density and job growth.6 Dense settings allow people and companies to better share the ideas, information, new market insights and tools that give rise to innovation, stimulate new company creation and further economic growth. While technology allows us to work remotely, companies are finding that they need the vibrancy and density of an urban-style environment in order to stay competitive — think Facebook’s “Main Street” campus design, Google’s cafeteria commons and every startup’s proclivity for open floor plans and collaborative workspaces.

If it’s true that the future of work is urban — that density, diversity and proximity are good for innovation — then New York, as the most urban place of all (at least within the United States), has a major advantage.

Economic diversity

It may make sense to think of tech not as an industry in itself but rather as a series of tools that can be used within other industries. Looking at the leading technology companies in both the Bay Area and New York City, we see that they are often in distinct industry “verticals” such as health care, energy, transportation, media, entertainment — the list goes on.

This means that the Bay Area economy may be much more diverse than is often assumed. But it also means that the tech ecosystem might benefit from co-location with other industries. If this is true, New York’s existing industry mix will provide important opportunities for innovation, disruption and transformation by people and firms working in many fields of technology. It remains to be seen what effect this will have on firm location patterns, but an argument can be made that industry diversity increases the attractiveness of New York.

Turning to the Bay Area…

There are some questions as to whether San Francisco should be treated as part of the Silicon Valley ecosystem or as its own hub. There is evidence of a growing divergence within the region: The San Francisco–Oakland urban core is attracting an increasing share of companies, deals and venture funding — a share that now exceeds that of the Santa Clara and San Mateo cities that make up the traditional heart of Silicon Valley.[7]

But economies operate at regional, not local, scales, where labor markets and anchor institutions such as universities are shared. And at this scale, the Bay Area faces increasing competition from regions like New York, London, Shanghai and Bangalore. As a region, the Bay Area has a lot going for it. We have a top-tier network of higher educational and research institutions that draw and nurture talent from all over the world. The quality of life the Bay Area offers appeals to highly skilled people from many backgrounds. We have a culture that embraces innovation. And we have a concentration of firms that benefit from being near each other because they can share talent and knowledge in all kinds of ways.

The classical economist Alfred Marshall, one of the originators of the concept of economic clusters (then called “innovation districts”), described this kind of concentration of industry in terms that resonate a century after he wrote them:

“When an industry has thus chosen a locality for itself, it is likely to stay there long: so great are the advantages which people following the same skilled trade get from near neighbourhood to one another. The mysteries of the trade become no mysteries; but are as it were in the air, and children learn many of them unconsciously.”

In the case of Silicon Valley, which has spread from its epicenter in Palo Alto to encompass San Francisco and much of the Bay Area, several distinct industry clusters are rooted here. And perhaps more than any specific industry, we have a culture of starting businesses with great ambition — a web of relationships, institutions and tacit knowledge that makes thousands of people feel empowered to start something new.

This startup system is composed of tangible resources like incubators, angels and advisors — the network of venture capital that takes chances on ideas that are novel and unguaranteed. But it is also composed of cultural attributes that are “in the air.” The exhortation to try something new, the acceptance of failure and the particular patterns of collaboration and trust create the special sauce that is essential but harder to replicate. Yes, the vast majority of new businesses will fail, but some will succeed. For many, the Bay Area is the place to go to start a business.

We don’t have a monopoly on these strengths. Other areas are working hard on achieving them. And the Bay Area has many challenges: a lack of investment in transportation infrastructure over many decades which has created a region that’s congested, difficult to navigate and increasingly disconnected; a lack of investment in public education since Proposition 13 which has made perchild spending in California nearly the lowest in the country;[8] the gridlock of our governing institutions, which makes it hard to solve problems and which has resulted partly from the trend toward making decisions at the ballot; and most urgently, the extremely high cost of housing in our region.

New York, is expensive too, of course, but because the broader New York region is better connected by transit, the greater New York labor market includes many areas of affordable housing in a way the Bay Area does not. Expanding urbanism in the Bay Area’s existing transit-served communities must be part of our economic thinking so that we can continue to be at the front waves of tech booms.

In the long run, the Bay Area’s economic competitiveness will depend on our ability to solve these kinds of fundamental problems, which will determine how hospitable the region is to innovation.

--

Endnotes:

[1] New York was recently declared the globe’s most competitive city now and for the foreseeable future by The Economist. See www.citigroup.com/citi/citiforcities/pdfs/hotspots2025.pdf

[2] Moneytree Report published by Pricewaterhouse Cooper and the National Venture Capital Association.

[3] Ibid

[4] Jonathan Bowles and David Giles. New Tech City. Center for an Urban Future. May 2012. Accessed 22 May 2013 nycfuture.org/research/publications/new-tech-city

[5] See business.time.com/2013/04/23/cornell-nyctech-hub-heres-why-a-qualcomm-billionaire-gave-133-million/

[6] Egon Terplan, The Urban Future of Work (2012), www.spur.org/urbanwork

[7] Richard Florida, “America’s Leading Metros for Venture Capital,” The Atlantic Cities, www.theatlanticcities. com/jobs-and-economy/2013/06/americastop-metros-venture-capital/3284/

[8] John Fensterwald, “California Drops to 49th in School Spending in Annual EdWeek Report,” EdSource, www.edsource.org/today/2013/california-dropsto-49th-in-school-spending-…