This fall, Santa Clara County residents will be asked to tax themselves for improved transportation. The county has a strong record of voting in favor of additional taxes to support transportation, including in 1996, 2000 and 2008. But it’s no secret that this year’s transportation sales tax has been politically contentious. This is where we have to separate the signal from the noise. The reality is, transportation investments have not kept up with job and population growth. Meanwhile, federal and state funding for transportation has declined. Although Congress passed a transportation funding bill in December, it was the first in 10 years and it's focused on highways. We will need better transportation infrastructure in order to enjoy continued prosperity and a high quality of life — and we’re going to have to pay for it ourselves.

Here’s why local investment is so important:

The county’s transportation infrastructure is deteriorating at a time when it will need to weather more demands.

The county’s local and regional transportation infrastructure is largely deteriorating. The City of San Jose alone has a $500 million backlog in road maintenance, and it will cost an estimated $72.5 million annually just to maintain current conditions. But this is not just San Jose’s problem — it’s one that many cities have been grappling with for years. Unfortunately, delaying maintenance on roads, buses and trains until it’s too late results in far greater costs than keeping them in a state of good repair.

At the same time, the county is growing, which will put more demand on transportation infrastructure. Santa Clara County is projected to grow by over 644,000 new residents (36 percent) and over 300,000 new jobs (33 percent).

The federal government pays for a fraction of our overall transportation budget.

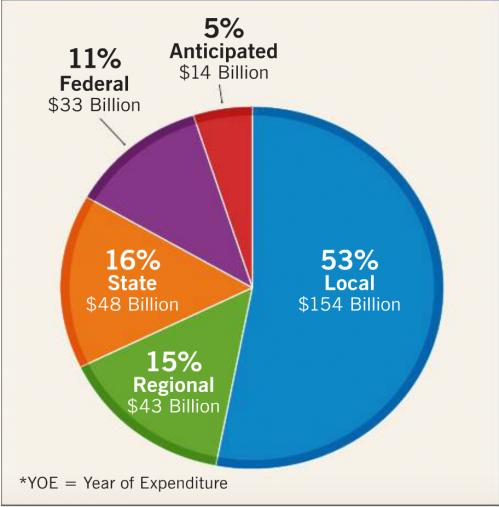

In 2015, the Congressional Budget Office found that federal spending on transportation infrastructure has fallen by about 19 percent since 2003. Only 11percent of the Bay Area’s transportation funding comes from the federal government. In addition, federal funding is increasingly unpredictable; in December Congress passed the first long-term transportation funding bill in a decade. This means we can’t rely on the federal government to pay for our growing transportation needs.

Only 11 Percent of the Region's Transportation Funding Comes From the Federal Government

Source: Plan Bay Area 2013

Worse still, the way we finance transportation encourages us to build more projects — particularly roads — while letting the ones we already have fall into disrepair. Almost all federal transportation dollars fund the construction of new projects (capital expenditures), leaving very little for ongoing operations, maintenance and improvements. That’s part of the reason local funding is so important. Santa Clara County residents recognized this when they passed 2000 Measure B, which will fund operations and maintenance for the BART Silicon Valley project.

Federal funds often require local governments to have skin in the game.

Federal funding programs frequently will not pay the full cost of a project and require a local funding commitment. This is true of the Federal New Starts program, which the Santa Clara Valley Transportation Authority estimates will provide about a quarter of the $4.7 billion funding need for the BART Phase II project.

State funding sources are dwindling.

Some transportation funding comes from state sources, primarily from gas taxes. But gas taxes make up a smaller and smaller share of our transportation dollars. This is because gas taxes haven’t kept up with inflation, which makes the overall purchasing power smaller. The tax is also tied to the price of gasoline, which is volatile. Due to falling gas prices since August 2015, California projects a $750 million shortfall for transportation projects that are supposed to be built in the next five years. At the same time, more people are driving fuel-efficient cars that require less gas. And if our elected officials and planners are successful, more people will live and work in complete communities that minimize the amount that they have to drive for their daily needs. The gas tax only loosely reflects actual road usage and no longer supports a sustainable source of transportation funding.

Conclusion

In an ideal world, we’d see comprehensive transportation funding reform. Until that happens, local investment is necessary to make up for some of the shortfall. But local funding will not be able to fund all of the transportation needs, so it’s important to spend local funds wisely. Investing in transit, pedestrian and bicycle infrastructure are high-return investments. We are the beneficiaries of major investments in BART and Caltrain that were made decades ago and that support our dynamic economy. If we can bring BART to the South Bay, we can complete “ring around the bay” that generations of leaders and residents have aspired to build, connect more people to more jobs, and relieve some of the pressure on our roads.