1. Executive Summary

Capital investments are the physical foundation of government service delivery, including our transit and road infrastructure, water and sewer systems, and buildings to house government services, police and fire stations, parks and recreation facilities, health, social service and community programs. Decisions about capital investments affect the availability and quality of most government services. This infrastructure is often taken for granted, yet is a cornerstone of the city’s economy, with implications for health, safety, and quality of life. Our chronic under-investment in San Francisco’s infrastructure imperils the physical foundations that support and connect modern life.

The city’s physical infrastructure is what permits economic activity to efficiently take place—it’s what allows people and goods to move, it’s what provides reliable water and energy, it’s what makes this city a place that people choose to be in.

San Francisco’s aging public facilities and infrastructure, with some elements dating back to the late 1800s, have been allowed to deteriorate. This neglect spans several decades. Even during times of fiscal health, mayors and boards of supervisors have not provided adequate annual funding for routine maintenance, repair, replacement, and capital improvements. And as the City fails to spend money to maintain its assets on an annual “pay-as-you-go” basis, there is a growing over-reliance on costly bond financing to address deferred maintenance.

When maintenance is deferred, the City’s infrastructure is allowed to deteriorate. Moreover, this deterioration accelerates over time, increasing the amount of money the City must spend to restore it to its original condition. As the amount of deferred maintenance grows, the infrastructure prematurely reaches a condition where it is cheaper to rebuild entirely than to catch up on maintenance. At that point, the City must issue bonds or other debt to pay for rebuilding the infrastructure, and pay the interest on the debt. This means the City must invest more frequently in its prematurely deteriorated capital stock and commit to new interest payments. Much of this spending could be avoided, and the life of our capital assets extended, by committing to an adequate level of annual maintenance.

At the same time, there is essentially no real process for prioritizing the vast array of capital needs in the city; any political constituency that can mobilize votes to pass a bond does so, and that’s often the extent of “capital planning.”

It is relatively easy for San Francisco to defer maintenance; the consequences are not apparent for many years. Political leadership recognizes that the crisis may not happen on their watch. They also earn little praise for addressing infrastructure needs. In addition, there are few advocates for increased spending on capital projects whereas there are countless advocates demanding increased funding for social, health, and other important community services, even though the delivery of effective, high quality services is frequently dependent on well maintained public facilities.

While capital planning and maintenance are not as glamorous as other hot-button policy issues,our neglect of the city’s infrastructure has huge implications for the City’s finances:

•The City has deferred an estimated $1.4 billion (in 2004 dollars) worth of maintenance over the last 20 years1

• This City currently has at least $2.4 billion in identified capital needs for General Fund-supported departments alone, in part as a result of deferred maintenance2

• Even if we use bonds and other financing to “catch up” on our deferred maintenance, we will need an estimated $84.5 million per year in General Funds to adequately maintain our existing assets going forward. Historically the City has budgeted only a small fraction of this amount.3

Governing magazine’s Government Performance Project in 2000 gave 35 cities an average grade of B for capital management and maintenance. The grades for California cities were: Long Beach B, Los Angeles C+, San Diego B+, and San Jose A-. San Francisco’s grade was C+. Governing stated,“San Francisco has a six-year capital maintenance plan, but it’s described by one official as a ‘realistic two-year plan. The rest is more of a wish list.’”

The deterioration of our public physical heritage harms our economy, limits the City’s ability to function effectively, exposes it to legal liability, endangers the public’s health and safety, and threatens its fiscal stability. The funding gap continues to grow, requiring a permanent solution.

Given the City’s current budgetary crisis, it may seem to some people an inopportune time to focus on new programs and funding for capital. However, the City has failed to make a commitment to its infrastructure in good times and bad times alike. Indeed, the City’s budget shortfalls may provide an opportunity to rethink the way we manage our capital investments, and impose a higher level of fiscal discipline that will have financial benefits over the long run—perhaps reducing the severity of future budget problems.

Even in times of fiscal stress public opinion may be solidly behind efforts to establish a pay-as-you-go financing method to maintain and repair our deteriorating public works as well as address financing of major capital projects. In April 2003, a Plan C Survey found over 90 percent of the respondents identified infrastructure improvements as “very” or “somewhat” important. Other public opinion surveys have similar results.

The passage of Proposition C in 2003, which mandated funding for performance audits on maintenance of parks, streets, and sidewalks is another indicator of the public’s concern about how well we are delivering services and maintaining our public facilities and infrastructure.

This paper proposes a set of policy reforms that will start to put in place a more effective capital planning and maintenance process for San Francisco, focused on the City’s General Fund departments. The paper divides the issues into two categories:

Major Capital Projects: How We Choose What to Build and How We Pay for It. Major capital projects are large investments in new infrastructure, or major rehabilitation of existing assets. These projects are too large to fund using regular annual revenues, and require long-term financing such as bonds or Certificates of Participation. Examples of the major capital projects in the study include replacing the Hall of Justice and General Hospital.

Routine Maintenance, Repair, and Replacement: How We Protect Our Investment in What We’ve Built and Will Build In the Future. Maintenance, repair and replacement projects are part of the normal year-to-year expenses associated with owning buildings and other capital facilities. They include repair and replacement of building components such as boilers, ventilation systems or recreation facilities. Repair and replacement projects are predictable and unavoidable expenses that occur throughout the life of our infrastructure, and should be paid for out of current revenues through the annual budget process. In this paper, we discuss the problems with current planning and funding for each category, and set forth the following recommendations:

1.1. RECOMMENDATIONS RELATED TO MAJOR CAPITAL PROJECTS

1. Establish a multi-year planning process for major capital projects. Put in place the processes for developing an annually updated needs assessment, prioritization of major capital projects, and funding strategies approved by the Capital Improvement Advisory Committee, Board of Supervisors and mayor.

2. Restructure the composition and responsibilities of the Capital Improvement Advisory Committee. Expand membership and participation by the public and revenue departments. Clarify the CIAC’s role as a policy and advisory body in the capital-planning process, and in approving the City’s capital plan.

3. Create a revolving fund to better develop the scope and funding requirements for bond programs prior to voter approval. The fund would be repaid using funds from successful bond measures.

4. Require cost estimates for annual spending needs resulting from new capital projects. Doing so will help the City anticipate the maintenance, repair, replacement, and operational costs of new capital projects, to avoid future deferred maintenance and unexpected ongoing General Fund commitments.

5. Coordinate capital planning with the Department of City Planning. Public capital investments should be coordinated with long-term plans for land-use changes.

6. Coordinate capital planning between General Fund Departments and “Revenue” Departments. Capital needs for revenue-producing departments are often separated from those of General Fund Departments. But citywide coordination of capital planning can increase the cost-effectiveness of the City’s capital programs and minimize disruption resulting from construction.

1.2. RECOMMENDATIONS RELATED TO MAINTENANCE, REPAIR, ANDREPLACEMENT

1. Establish a budget set-aside for capital maintenance. Earmarking a portion of General Fund revenues for capital maintenance will improve the condition of our infrastructure and save the City millions of dollars.

2. Develop a program to track annual routine maintenance, repair and replacement needs and provide data to assist in allocating capital funds. Improved data collection will allow departments to plan repairs and improvements, coordinate inter-department and private utility, project repair and replacement schedules and costs, and forecast capital expenditures.

3. Earmark a portion of General Fund support to the School District for deferred maintenance. In March 2003, voters approved Proposition H, which mandated General Fund support for the San Francisco Unified School District. One-third of the funds are not designated for a specific purpose. The Board of Supervisors and Mayor should work with the school district to earmark these monies for deferred maintenance.

4. Clarify the Rainy Day Fund capital provision. The requirements for capital funding in the Rainy Day Fund should be clarified to ensure the funds represent a net increase in capital investment.

5. Consider options for requiring departments to budget the true costs of maintenance. Over the long run, the City should explore moving to a real estate management model where the true costs of capital maintenance are reflected in departmental budgets. The Federal General Services Administration (GSA) could be a model for management and maintenance of City facilities.

2. MAJOR CAPITAL PROJECTS: HOW WE CHOOSE WHAT TOBUILD AND HOW WE PAY FOR IT

In this section, we discuss the City’s processes for planning and funding major new General Fund capital projects that require long-term financing. These projects generally involve construction of new infrastructure (such as recreation centers, police stations, or libraries) or major rehabilitation of infrastructure that is so deteriorated in can no longer be repaired with normal annual tax revenues. There is some overlap between the issues and recommendations in this section and those in Section 3, which deals with the smaller maintenance and repair projects the City should fund on an annual basis.

Major capital projects are long-term investments in infrastructure. Because major capital projects cost more than is available from normal tax revenues, and have benefits that extend over many years, they are generally appropriately financed using different types of debt. There two basic long-term capital financing tools for General Fund projects:

• General obligation (G. O.) bonds, approved by a two-thirds vote of the electorate and repaid through a temporary increase in the property tax

• General Fund lease revenue bonds (or Certificates of Participation), approved by a majority vote of the electorate (there are ways to structure General Fund leases without the voter approval requirement in the City Charter, such as the financing for the new County jail in San Bruno), and repaid using general City revenues.

G.O. bonds are clearly the more powerful financing tool, because a new source of tax revenue is approved to pay for all debt service. Certificates of participation and lease bonds have to be paid from existing General Fund resources, meaning the resource pie isn’t any bigger, but existing revenues are leveraged to finance debt. General Fund lease revenue bonds make sense in cases such as moving a City function from a rented to an owned space to save on occupancy costs.

The other major capital financing tool for major projects is revenue bonds, where an existing or a new revenue stream is often used make funds available to repay debt.

These capital financing tools are not mutually exclusive—it is possible to mix different tools in the same financing, and sometimes this can result in a superior financing structure. For example,the $299 million G.O. bonds already authorized for the Laguna Honda Hospital replacement project will have debt service officially secured by property taxes, but debt service will actually be paid by tobacco settlement receipts to the maximum extent possible. The $157.5 million General Fund lease revenue bonds sold several years ago to finance the Moscone Center West expansion project are officially secured by a General Fund lease, but debt service is budgeted from certain specified hotel tax receipts.

2.1. WHY CAPITAL PLANNING MATTERS

In the private sector, there are clear criteria for determining which capital investments to make and when to make them. Businesses can simply project the financial returns of competing proposed capital investments, and choose the ones that maximize profits. City government often does not have the same luxury. Although the social and economic benefits of government capital investments are real, they are often difficult to measure since they are not captured in revenue streams. Nonetheless, different investments will have different implications for the city. Since City government has limited resources for capital investments, it must have a process for selecting those with the greatest public benefits, to make sure taxpayers receive the maximum return on their investment. It is therefore important that government have a clear assessment of its needs and a process for comparing the relative benefits of different projects with one another.

Effective capital planning also has direct financial implications for City government. When the City issues bonds and other forms of debt, it pays different interest rates based on the perceived risk in the capital markets that the City will default on its payments. Bond rating agencies, which assign a level of risk to City bond issues, have noted the lack of an effective capital plan as a factor that could negatively impact San Francisco’s bond rating. Thus, the failure to plan for major capital projects could lead the City to pay higher interest rates on the debt it issues.

2.2. THE SIZE OF SAN FRANCISCO’S MAJOR CAPITAL NEEDS

In 2003, the San Francisco Department of Public Works (DPW) began an investigation into the City’s General Fund department capital needs (revenue-producing departments including the Airport, Public Utilities Commission, MTA and Port are not included in the needs assessment, nor are other general capital needs such as affordable and supportive housing, which have been the subject of recent bond proposals). The draft DPW report identifies the following major capital improvement needs (See Fig. 1).

Figure 1: Summary of Major Capital Needs and Sources by General Fund Department

| Department | Capital Need |

| Academy of Sciences | $379,000,000 |

| Administrative Services | $752,435,000 |

| Arts Commission | $46,264,100 |

| Emergency Communications | $201,300 |

| Fire | $97,518,180 |

| Human Services | $8,439,917 |

| Juvenile Probation | $58,946,895 |

| Police | $125,688,194 |

| Public Health | $1,276,201,197 |

| Public Library | $108,139,000 |

| Public Works | $12,000 |

| Recreation and Park | $769,982,690 |

| Sheriff | $10,000,000 |

| Telecom and Information Services | $13,000,000 |

| Trial Courts | $160,000,000 |

| War Memorial | $135,000,000 |

| Total | $3,940,828,473 |

| Identified Sources | $1,488,661,876 |

| Unfunded Need | $2,452,166,597 |

This is an initial need assessment based on interviews with departments and the limited data available on City facilities. For example, the Administrative Services need includes a long-overdue rebuild of the Hall of Justice, and the Department of Public Health need includes an estimate for the cost of rebuilding General Hospital as mandated by state law. The identified sources include voter-authorized bonds, state and federal funds, and other revenues that are known to be available.

2.3. SAN FRANCISCO’S MAJOR CAPITAL NEEDS IN PERSPECTIVE

The $2.4 billion in unfunded major capital improvements identified by DPW is no small obstacle. While not all of these needs would be funded using general obligation (G.O.) bonds, a comparison to the City’s G.O. bond debt helps to put this amount in perspective.

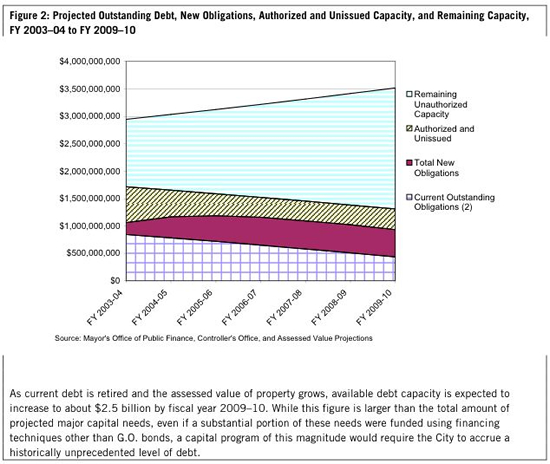

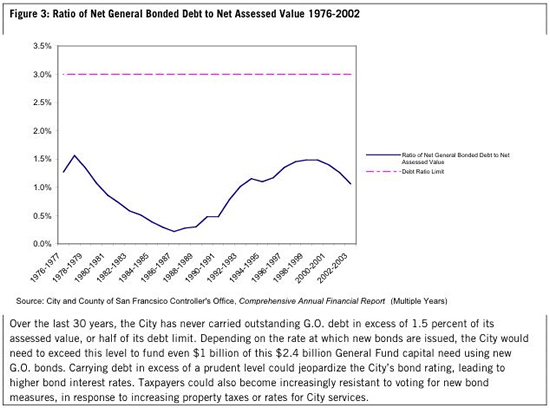

The City currently has roughly $1 billion in outstanding general obligation (G.O.) bond debt, not including another $655 million in authorized but unissued bonds. About $300 million of the unissued bonds is for the unreinforced masonry building seismic loan fund, which has by most accounts proven financially infeasible. In order to ensure that the City’s debt burden will not become excessive, leading to financial problems and unsustainable tax burdens on property owners, the City Charter limits the total amount of G.O. bond debt the City can carry to three percent of the taxable assessed value of property in the City. It should be noted that the three percent legal limit is not the only determinant of the level of debt the City can take on. The interest the City pays on its debt is determined by the investment markets and by rating agencies that assign a level of risk to the City’s bonds and other debt. When the City’s debt burden grows, the perceived risk of investing in city bonds or other debt grows as well, increasing the interest rates the City must pay to take on debt, and eventually making it prohibitively expensive for the City to issue new debt. This market-driven level of debt is also known as the “prudent debt limit,” and is generally considered to be closer to one and a half to two percent of assessed value. Similarly, the purpose of the legal debt limit is to hold down the City’s overall debt burden, and reduce the risk it will default on its debt payments, thereby keeping down the interest rates it pays on its debt. The legal debt limit is currently about $3 billion. Thus, the City currently has roughly $2 billion in available debt capacity, or 20 percent less capacity than the total capital need identified by DPW. Figure 2 shows San Francisco’s current outstanding and projected G.O. debt, authorized but unissued bonds, and G.O. debt capacity.

Figure 3 shows San Francisco’s historical level of debt as a percent of the assessed value of property in the city.

2.4. RECOMMENDATIONS FOR CAPITAL PLANNING

2.4.1. Establish a Multi-Year Planning Process for Major Capital Projects

Despite the fact that the City faces at least $2.4 billion in capital needs in the coming years, the process for choosing and funding capital projects is erratic and excessively political. The constraints of our bonding capacity, the voters’ willingness to approve bond measures, and scarcity of City funds makes it imperative that we begin making the difficult choices about which projects to fund, and in what order. Currently, bond programs are placed on the ballot by the Board of Supervisors, often with insufficient design, engineering, planning, cost estimating, prioritization, or comparison to competing capital needs. This lack of information is not a result of indifference by the Supervisors, but of inadequate systems and funding for capital planning efforts. While the City prepares bond reports for proposed bond measures, the financial and organizational resources are often not available to develop them with a sufficient level of accuracy and detail. There is also limited public involvement in planning many bond programs prior to the election. A primary purpose of a capital plan is to provide context for decisions about the City’s capital investments. Much like San Francisco’s neighborhood planning efforts, which seek to develop consensus on a general direction for neighborhood development up front rather than in battles over individual projects, a capital plan would help provide a holistic look at our capital needs rather than evaluating them individually at the ballot box. A capital-planning process allows for at least some level of analytical comparison of the costs and benefits of individual projects, as well as an opportunity to evaluate projects against one another on their relative merits. Ideally, it should provide a citywide perspective, explore various financing options, and facilitate project coordination.

It is unrealistic to presume that better planning will fully rationalize the City’s capital investments. There will assuredly continue to be cases where politics trump planning, and in many cases electoral politics is an appropriate venue for expression of citizens’ preferences on capital projects. In addition, better planning alone cannot solve our infrastructure problems if it is not accompanied by adequate funding. However, an established capital-planning process can bring better information, planning, and analysis to what are ultimately political decisions.

The Board of Supervisors, Mayor, and, if necessary, the voters, should adopt a requirement that the City prepare and continuously update a multi-year plan for major capital improvements. SPUR recommends the following for development of a capital plan:

Needs Assessment. The plan should contain a needs assessment, annually or biannually updated, based on current data, with a comprehensive list of all capital needs from each City department, including enterprise departments.

Long-term Time Horizon. The plan should be based on six-year (or longer) time horizon. A longer time horizon than the one-year budget cycle is appropriate for planning large capital projects.

Prioritization. The plan should prioritize capital needs to help determine the order in which projects should receive funding and bonds should be submitted to the voters, based on a transparent and explicit set of criteria.

Funding strategies. The plan should explore funding strategies for different projects, including contingency plans in the case that voters fail to approve funding mechanisms such as bonds or lease-revenue-financing proposals.

Approval by the Board of Supervisors and Mayor. The plan should be approved by the Board of Supervisors and mayor. Approval by the Board will increase the likelihood that the plan and its priorities will be implemented, since the Supervisors will have an opportunity to debate the plan and go on record in support of its policies and a sequence of capital project priorities. Mayoral support for a plan is also clearly essential.

Mechanism to Ensure Compliance With the Plan. To ensure the capital plan has “teeth” and is not simply ignored, SPUR recommends that once a planning process is implemented, the Supervisors agree to a moratorium on submission of bond proposals to the voters until they have adopted the plan. An even stronger requirement, albeit one that would reduce the flexibility of the Board and voters to pursue capital projects, would be to prohibit submission of any bond or other capital program to the voters that is not among the top priorities in the capital plan. Although such a provision would strengthen the effect of the plan, it could potentially end up as a barrier to new capital investments. In addition, such a prohibition on bonds not included in the plan’s top priorities could reduce the ability of the mayor and Board of Supervisors to respond to emergencies. For example, after an earthquake, it would be necessary to do an emergency rewrite of the plan to respond to capital needs caused by the disaster. However, this problem could be largely alleviated by requiring a high supermajority vote threshold by the Board of Supervisors to override the plan’s priorities.

Who Should Develop the Capital Plan?

The plan should be developed under big-picture policy guidance by the Capital Improvement Advisory Committee (CIAC), which is established in the Administrative Code to review capital projects. In addition, the CIAC should approve the plan in its final form. However, the staff work involved creating in this plan should be managed by a department, not directly by the CIAC. As discussed elsewhere in this report, the CIAC does not have the staff or administrative capacity to carry out the day-to-day development of a capital plan (for further discussion and recommendations concerning the CIAC’s role in the capital-planning process, see Section 2.4.2 of this report.) To be successful this planning effort will require permanent technical and analytical staffed housed in an agency with ultimate responsibility for delivering the plan at a set time coordinated with the City budget process. There are multiple options for where this program should be located within City government. As stated previously, Department of Public Works (DPW) staff, with guidance from the Mayor’s Office, have begun a modest capital-planning effort. Possible locations for these new functions include:

The City Administrator’s Office (CAO). SPUR believes the CAO is the most logical location for the capital-planning function. Under the City Charter, the City Administrator is responsible for “administering policies and procedures regarding bonded or other long-term indebtedness” and “coordinating all capital improvement and construction projects except projects solely under the Airport, Port, Public Utilities and Public Transportation Commissions.” It is a relatively “neutral” agency, and has no financial stake in capital-planning decisions. The CAO is supposed to carry out core administrative functions, and many elements of the capital-planning process fit this bill, including data management and compilation of citywide needs assessments. The problems with the CAO as a location for the capital-planning function is that it has little capacity for the more policy oriented components, such as involvement in prioritization of major bond programs and management of public input. In addition, the office greatly declined in responsibility, political importance, and overall capacity during the last mayoral administration. If this office is restructured to have a greater level of capacity and responsibility, it should be the primary location for capital planning.

Department of Public Works. One option is to continue housing this program within DPW. The advantage of this location is that DPW has a high level of engineering, architectural, and technical competence relative to other City agencies. However, DPW is involved in implementing many capital projects, and thus has a financial stake in the outcome of the planning process. Furthermore, DPW may be naturally inclined to focus on buildings and roads, which are its primarily responsibilities, and away from other important projects such as sidewalk widening, parks, or enterprise department capital projects.

Department of City Planning. Location in the Department of City Planning would have the benefit of integrating capital planning with other planning efforts for physical development in the City. The Department of City Planning is organized to deal with ongoing, big-picture planning issues from a citywide perspective, making it a logical location for prioritizing an analyzing new capital investment. Disadvantages of the Department of City Planning as a location for capital planning include the fact that a large element of the data tracking and prioritization of smaller maintenance, repair and replacement projects is essentially a technical facilities management and engineering exercise, rather than one that requires vision or planning expertise. The responsibilities of the Planning Department do not relate to scheduling of maintenance investments, making it less appealing as a location for an integrated capital planning function. However, because of its central role in physical development issues, the Department of City Planning should be intimately involved in capital planning no matter where the function is located, as discussed elsewhere in this paper.

Mayor’s Office of Public Finance. The Mayor’s Office of Public Finance (MOPF) is responsible for managing bond, Certificates of Participation, and other debt financing mechanisms for major capital projects. This connection with capital issues, and the financial and analytical nature of the office, make it a conceivable location for the capital-planning function. The primary drawbacks of MOPF are that it currently has a relatively small staff that is highly focused on finance, as opposed to technical and policy issues. Its current competencies are in many ways very different than those that would be required to run a functional capital-planning effort.

2.4.2. Restructure the Composition and Responsibilities of the CIAC

The CIAC is the closest thing San Francisco currently has to a capital-planning entity. It reviews proposed capital improvements and recommends funding. The CIAC is established under Chapter 3 of the San Francisco Administrative Code, and consists of the Mayor’s finance director as chair, the president of the board of supervisors, the city administrator, the controller, the director of public works, the director of the department of city planning or their designees and two individuals chosen by the chair of the CIAC to serve two-year terms. It does not require participation by enterprise departments (e.g. the Public Utilities Commission). Departments are required to submit capital improvement projects and long-term capital financing proposals to the CIAC for review. The CIAC must make recommendations on long-term financing proposals before they are authorized or submitted to the ballot.

However, in reality it is largely advisory and has little substantive authority or resources to carry out meaningful planning or analysis. Capital-planning functions involve a mixture of policy decisions and technical tasks. In its current form, the CIAC is better suited to making policy decisions, since it is composed of high-level officials from several departments. However, it lacks the capacity for technical analysis, data gathering, cost analysis, and planning that are central to capital planning. In addition, the CIAC meets infrequently and has gained little traction as a functional participant in policy making or implementation. This is not the fault of its members, but simply a result of its status as an “orphan” institution composed of high-level representatives from multiple agencies with no staff of its own.

The CIAC should continue to play a role in capital planning, since collaboration and communication between political leaders and officials from the departments represented is important for a functional and balanced capital plan. But this role should be adjusted to reflect its nature as an institution that is not designed to effectively manage technical staff or planning. In order to give the CIAC an appropriate role in the capital-planning process, several changes are required:

• Articulate the scope and timing of the multi-year capital plan, and clarify the CIAC’s role in policy setting, oversight and approval of the capital-planning process, rather than as the entity responsible for producing the document.

• Continue to require CIAC recommendations on bonds and other major capital projects.

• Require CIAC approval of a capital plan before submission to the mayor and Board of Supervisors.

• Expand representation of revenue departments in CIAC processes.

• Increase public participation in priority-setting for major capital projects. This change could include expanding membership on the CIAC to include appointed citizens, or forming a citizens committee to meet annually to advise the City and CIAC on capital investment priorities. It should also seek input from the various citizen oversight committees involved in capital issues. Other cities have successfully engaged citizens in the capital prioritization process. 4

2.4.3. Create a Revolving Fund to Better Develop the Scope and Funding Requirements for Bond Programs Prior to Voter Approval

The process of identification of capital bonds for voter approval and the execution of bond financed projects has been problematic at best. The projects contained in a bond are not usually properly scoped and investigated to a degree that can assure that the bond financing will cover all proposed projects. Voters become disenchanted when the bonds they supported do not achieve their objectives, especially when libraries, schools, parks, police and fire stations, sewers, water systems, and other projects are shortchanged, not renovated or built, or are over-budget and off schedule. These problems weaken public support for bond-financed public works projects.

This problem stems in part from the manner in which we develop our bond proposals. Managers in City departments are well aware of the importance of adequately studying bond proposals, but funding is not often available to fully develop a scope of work and a reliably estimated cost for the projects identified in a bond program. Only after the voters have approved a bond and a portion of the bond funds have been expended to fully develop a capital program does it become clear what can be accomplished with the bonds authorized. Moreover, the current process for developing bond measures is almost entirely political. Bonds are submitted to the ballot by the Board of Supervisors, and require a two-thirds vote of the electorate to pass. The political incentives created by this system are not geared toward developing an accurate or realistic assessment of what can be accomplished with a given level of bond funding. Supervisors benefit politically in the short term from supporting bonds that purport to deliver large capital projects to their constituencies. In addition, the two-thirds threshold requires that bonds be made as politically appealing as possible to secure approval, even if they are unrealistic.

The City should establish a revolving fund, administered by the entity responsible for capital planning, to pay for improved scoping and development of bond proposals prior to submission to the voters. The City would need to allocate start-up funding. After that point, a small portion of bond funds from voter-approved bonds would be used to repay the fund, which could then be used to pay for studies for subsequent bonds.

There are a couple issues that would need to be addressed in order for a revolving fund of this nature to function effectively and efficiently: there would need to be a trigger for determining which of many competing bond proposals would receive funding—this decision should be made by the CIAC according to formal criteria. The level of detail of each study would need to be determined to ensure cost-effective use of funds, balancing the need for information with the cost.

Over the past 20 years, San Francisco voters have approved 26 bond measures worth approximately $3.79 billion, and rejected 16 measures worth $1.5 billion. This means that over that period, 41 percent of bond measures (worth 25 percent of the total bond funds proposed) did not receive voter approval. Because voters will not approve all bonds, there will not be funds to repay all of the spending undertaken by this fund. Thus, it would be necessary to supplement this fund from time to time with other revenues, or to require a higher level of repayment from successful bond measures than was actually used on those programs—though such a provision may face legal issues associated with the use of bond funds.

2.4.4. Require Cost Estimates for Annual Spending Needs Resulting From New Capital Projects

One reason for San Francisco’s backlog of deferred maintenance, and the associated cost inefficiency, is that major capital projects often move forward with inadequate consideration of the annual maintenance funds that will be required to prevent deterioration.

A number of cities, including Seattle and Minneapolis, now require that bond and other long term financing proposals include estimates of the costs to maintain a new facility over its lifetime. Having this information present at the time major capital proposals are developed and submitted to the voters will help plan for future investments and keep policymakers and voters aware of the long-term budgetary impacts of new capital projects. The CIAC, Board of Supervisors and mayor should formally require that this information accompany all capital proposals. The estimate should be developed by the staff responsible for capital planning and the controller, and made widely available to voters at election time.

2.4.5. Coordinate Capital Planning With the Department of City Planning

Capital-planning efforts should be coordinated with activities at the Department of City Planning, including review of capital projects for conformity with the General Plan and neighborhood planning efforts, and for consistency with the long-term changes in the city.

The Department of City Planning is the primary City agency responsible for thinking broadly about the city’s future. Public capital investments shape our public spaces and are critical to facilitating the physical development of the city. They should be coordinated with plans for residential, commercial and other forms of development. This means that capital investments should be made to increase the accessibility and environmental quality of areas where growth is slated to occur, such as the area where neighborhood planning is taking place.

The Charter and Administrative Code envision capital planning efforts to be an integral part of the planning activities of the Planning Department. The Charter (Sec 4.105) provides that “the Planning Commission shall develop and maintain a General Plan consisting of goals, policies and programs for the future physical development of the City and County.” Administrative Code Article III Sec. 2A.51 provides: “The Planning Department shall advise the Board of Supervisors and other departments, commissions and agencies of the City and County in any matter affecting the physical improvement and development of the City and County.”

Furthermore, Administrative Code Article III Sec.2A.52 provides that the Capital Improvement Advisory Committee cannot act a capital improvement project or a long-term financing proposal until a General Plan referral report has been rendered by the Planning Department regarding conformity of the project with the General Plan. Despite this requirement, the recent SPUR report “Planning for the Future” found the following: “this finding of General Plan conformity has been relegated to the tail end of every capital planning effort, making it essentially a meaningless rubber stamp. Measuring consistency with the General Plan could and should be a real planning tool to make sure that other City departments are not acting as free agents, but are instead working together to fulfill long-range plans for the city’s evolution.”

As discussed above, the Department of City Planning is a potential location for capital-planning staff. However, even if the Department of City Planning is not the primary agency responsible for preparing a city wide capital plan, it should take a leadership role in development of capital priorities. This means that the department’s involvement must be more than a rubber stamp of conformity with the General Plan for capital projects. It should facilitate a serious review and analysis of the cost-effectiveness and public benefits of those investments based on expected long term changes in the city. To accomplish this vision, a small number of new staff positions would be needed at the Department of City Planning.

SPUR believes using set-aside funds and capital investments that facilitate the success of the neighborhood planning programs should be given preference. Greater assurance of funding for neighborhood improvements such as street trees, park upgrades, traffic calming, and transit enhancements could help encourage neighborhoods to accept greater density and expanded development opportunities detailed in these plans.

2.4.6. Coordinate Capital Planning Between General Fund and “Revenue” Departments

Capital needs for revenue-producing departments are often separated from General Fund Departments, since revenue departments often have their own revenue streams to support financing for new facilities and infrastructure. But capital investments for all City departments should be planned together in order to coordinate capital projects in specific parts of the City and over time.

Citywide coordination of capital planning can increase the cost-effectiveness of the City’s capital programs. Often, lack of communication between City departments has led to a loss of potential economies of scale and other inefficiencies in implementation. For example, the City has been known to repave a street, then soon after dig up the same newly paved street to repair utility infrastructure or make other transportation improvements.

In addition, a lack of coordination can lead to capital decisions that lower costs for one department but at the same time externalize substantial new costs on other departments. For example, capital investments that affect stormwater runoff also affect the need for capacity in the sewer and water treatment systems. Although it may appear to be cheaper overall for individual departments to shift the costs of dealing with stormwater runoff to the PUC rather than make new investments to increase absorption of water in the ground, on the aggregate this lack of coordination can cost the City. By improving coordination with revenue departments, instead of a single department or groups of departments acting alone, the City can find ways to reduce overall operating costs by more efficient infrastructure investments.

3. MAINTENANCE, REPAIR, AND REPLACEMENT: HOW WE PROTECT OUR INVESTMENT IN WHAT WE’VE BUILT AND WILL BUILD IN THE FUTURE

3.1. WHY ANNUAL MAINTENANCE, REPAIR, AND REPLACEMENT SPENDING MATTERS

Although deferring maintenance is generally one of the first things the City does to cut costs in difficult budgetary years, over the long term doing so is costly for both City government and taxpayers. A number of economic studies have linked public infrastructure investment with economic growth as a result of higher productivity and quality of life. Most staff and managers in City departments are well aware of the maintenance problems they face, and would like nothing more than to commit to an adequate level of maintenance. However, the financial resources, processes, and political will are often simply inadequate to make this possible.

Deferring maintenance is not a cost effective way to manage City government’s resources. Buildings and other infrastructure have a shorter useful lifespan when they are not maintained. As infrastructure deteriorates, a process that is accelerated by a lack of maintenance, it eventually reaches a condition where it is cheaper to simply rebuild the infrastructure from scratch than it is to catch up on maintenance. Once a facility has reached that stage, it often becomes a major capital project, which the City must finance using bonds or other forms of debt. This results in the need for more frequent rebuilding of infrastructure, and requires the City to pay interest on the debt for these projects. Thus, by deferring maintenance to reduce expenses in the short term, the City ends up spending more money in the long run to restore its prematurely deteriorated infrastructure. Although it is difficult to accurately quantify the amount of money the City wastes by deferring maintenance, some research indicates that maintenance efforts can reduce the lifecycle costs of certain types of infrastructure by as much as 75 to 90 percent, primarily by extending the life of capital assets and making costly replacements less frequent.5 Figure 4 illustrates this process.

This situation is aggravated by the fact that deterioration of many types of infrastructure tends to accelerate over time. For example, road pavement quality has been observed to decline by 40 percent over the first 15 years of its life, then another 40 percent over the next 5 years. This pattern of deterioration is illustrated in Figure 5. Because of this accelerated decline, one dollar of investment in maintenance while the road is still in good condition will have the same effect as a four or five dollar investment if maintenance is deferred a few years.

Deferred maintenance has other affects on government’s ability to deliver to the public the maximum amount of services per dollar it spends. Sufficiently maintained facilities such as government office buildings can improve the productivity and job satisfaction of the government work force. In addition, periodic investments in facilities lead to other improvements, such as increased accessibility and more modern amenities that facilitate the use of cost-saving technology.

When the City defers maintenance, it is essentially liquidating its capital assets by allowing them to deteriorate in order to free up cash for other programs. But by doing so, the City ends up spending a higher total amount of funds on its capital needs, leaving fewer funds for other programs. Deferring maintenance is “penny wise, pound foolish,” and at the end of the day leads to waste of government resources and a failure to deliver the maximum level of services per public dollar.

3.2. THE SIZE OF SAN FRANCISCO’S MAINTENANCE, REPAIR, AND REPLACEMENT NEEDS

San Francisco lacks reliable, useful data about its capital and maintenance needs. While managers are generally aware of the department’s own capital needs, there is little centralized effort to collect his information outside the limited needs submitted in the annual budget process. From time to time, the City has attempted to gather data on these needs, but there has not been a sustained effort and much of the data collected is now out of date.

The Chamber of Commerce’s 1983 Strategic Plan stated, “San Francisco is not adequately funding its capital and maintenance needs. The annual shortfall is estimated at $30 to $40 million for capital improvements and $10 to $20 million for maintenance.” In 1983, the infrastructure expenditure gap was manageable.

The Strategic Plan could only estimate the magnitude of the problem because, like today, the City did not have a systematic means to evaluate the condition of its facilities or the cost of deferred maintenance. The plan called for the development of a Capital Asset Management System (CAMS). Former Supervisors Bill Maher and Louise Renne sponsored CAMS legislation. Former Mayor Dianne Feinstein, the late Peter Henshel and former CAO Roger Boas implemented the system. CAMS identified a substantially higher unfunded deferred maintenance and capital financing problem. Unfortunately, subsequent mayors allowed CAMS to wither away, once again leaving the City with limited information about the magnitude of the problem. In 2001 the City discontinued use of CAMS.

Today, centralized information on the City’s capital assets is woefully inadequate and out of date. While managers are often aware of their department’s needs, here is little pertinent information for informed policy and budget decisions by elected officials and the electorate. However, we know that the capital and facilities maintenance needs of the City have grown substantially over the last 20 years.

In 2003, the San Francisco Department of Public Works (DPW) began an investigation into the City’s General Fund department capital needs (leaving out revenue-producing departments including the Airport, Public Utilities Commission, Municipal Transportation Agency and Port). The draft DPW report identifies $33.5 million in identified repair and replacement needs for General Fund departments in FY 2004-05.

The repair and replacement needs in these estimates include only the 16 major General Fund supported departments.6 This means cost estimates for street trees, sidewalk widening, transit infrastructure, repair of the waterfront piers, rehabilitation of historic properties on Port land, schools and a wide range of other infrastructure are not included.

The $33.5 million figure for repair and replacement need covers only those projects for which Departments have requested funding. This figure is extremely low, since in difficult budget years when funds are scarce, departments are instructed to submit only the most urgent capital requests. Consequently, $33.5 million represents only a portion of the need for annual funding.

DPW has estimated the actual annual funding need at a much higher level by using a formula to calculate annual investment need based on the replacement cost of its capital stock. A guideline developed by the National Academy of Sciences and widely cited in the facilities management literature is that property owners should budget, on average, two to four percent of the replacement cost of a facility annually.7 It also estimates (in the absence of actual data on the condition of facilities) that the City would need to spend on average approximately $84.5 million per year going forward to satisfactorily maintain the City’s existing General Fund Department capital assets. Their estimate for annual funding is $84.5 million using very conservative assumptions. This figure does not include the funds needed to “catch up” on past decades of deferred maintenance—it is simply an estimate of the amount we should spend each year to maintain a capital stock of San Francisco’s size.

Deferred Maintenance

In recent history the City has never come close to reaching the estimated $84.5 million optimal annual funding level. Figure 6 shows the historical General Fund allocation for capital and facilities maintenance, adjusted for inflation and compared to the estimated optimal level of funding using the replacement cost method.

Over the last 20 years, the City’s capital and facilities maintenance budget reached a high of about $43 million in FY 2001-02, at the end of the economic boom of the late 1990s. This figure is substantially higher than in most years. The 20-year average allocation between FY 1983-04 and FY 2003-04 is about $17 million. Calculating the difference between actual spending and the $84.5 million annual estimated need yields an estimate of over $1.4 billion in deferred maintenance over the last 20 years. This estimate is conservative, since some of the money in the General Fund capital and facilities maintenance allocation is actually bond program funding recorded as a General Fund appropriation.

Some of this deferred maintenance has been taken care of through capital programs, where poorly maintained facilities are simply rebuilt using bonds, certificates of participation, or other long-term capital financing methods. However, as discussed elsewhere in this report, it is not cost effective to defer maintenance until the need becomes so great that a major capital program is required. Doing so increases the frequency of major capital programs and essentially makes the City fund this maintenance through debt, along with the associated interest payments. This means that saving money by deferring maintenance ends up costing more in the long run and, conversely, timely maintenance reduces costs in future years. Nor is it responsible to ask taxpayers to pay for 30 years of debt interest to repair a roof with a lifespan of 20 years.

3.3. RECOMMENDATIONS FOR MAINTENANCE, REPAIR AND REPLACEMENT

3.3.1. Establish a Budget Set-Aside for Capital Maintenance

SPUR, along with many in City government, has reservations about setting aside or earmarking monies in the General Fund for special purposes. General Fund set-asides reduce the total amount of discretionary funds that are available to policymakers to work with during the budget process. This reduces their flexibility to respond to budget shortfalls, set priorities, and change levels of program funding to best meet the City’s needs. These policy makers are often the people with the most information at their disposal about City government and budgetary circumstances. For this reason, our democratic process delegates these types of decisions to elected officials and their appointees.

However, the political realities facing mayors and boards of supervisors make it difficult for them to consistently fund capital maintenance despite the best intentions. There is little political incentive, especially given term limits for elected officials, to make a priority of the long-term issue of maintenance. The history of under investment provides ample evidence that the normal budget process does not provide adequate funding for capital and infrastructure maintenance.

In many respects, capital maintenance is also a special case in terms of budgeting. Insufficient capital maintenance is fundamentally wasteful, leading to greater expenses for government over time and reducing the amount of public funds available to pay for important discretionary programs. In such a case, imposing a higher level of fiscal discipline will in the end be more cost effective, offsetting many of the principled concerns with set-asides. After careful consideration SPUR concludes that there is no other recourse than setting aside a percentage of the annual budget to maintain our valuable facilities and infrastructure.

In 2000, the SPUR Board of Directors formally endorsed the concept of a General Fund set-aside to fund capital maintenance. A SPUR task force, working with then-Supervisor Gavin Newsom, drafted a Charter amendment establishing a General Fund Deferred Maintenance Fund to reduce deterioration and obsolescence, and enhance the functional usefulness of the city’s facilities, public works, and infrastructure. Despite its promising start, the Charter amendment never made its way through the political process to the ballot.

The proposed Charter amendment included a set-aside of a percentage of the annual General Fund appropriation. Initially, an amount equal to 1.75 percent of total General Fund revenues would be deposited in the fund, rising in subsequent fiscal years by 0.25 percent to a maximum of 3 percent. (If three percent of the General Fund for 2004–05 fiscal year were earmarked for the Fund, approximately $70.1 million would be available for capital.)

By tying the set-aside to a percentage of annual appropriations, the amount earmarked for the Fund fluctuates with the City’s fiscal condition, whereas other set-asides set an amount that does not rise or fall with the City’s fiscal health. This set-aside proposal does not increase the total level of General Fund appropriations or taxes.

The Municipal Transportation Agency, as a quasi-enterprise department (the MTA generates some of its own revenues, but unlike a “true” enterprise department it is not totally self-supporting), would qualify for set-aside funding. Other enterprise departments would continue to fund ongoing maintenance projects from their own revenue streams.

Establishing a deferred maintenance set-aside will lessen the dependence on costly bond financing thereby saving taxpayers millions of dollars over time. Improvement in the financing of deferred maintenance will extend the life of the City’s assets, enhance employee productivity through better working conditions, make technological improvements, bring facilities up to code, and improve delivery of services to residents, visitors and businesses.

Many of the projects financed by a deferred maintenance set aside would be smaller contracts enabling small businesses and disadvantaged firms to bid on these contracts. An ongoing pay-as-you- go deferred maintenance financing set aside would pump funds into San Francisco’s economy, create jobs, and generate new business and sales taxes for the City Treasury.

Another benefit of a deferred maintenance set aside is to maintain public facilities that have architectural, environmental and historical significance. All too often these remarkable structures are allowed to deteriorate, closed, or destroyed by benign neglect to the point that they become a major capital project requiring bond financing to bring them up to a usable standard and return them the significance that citizens covet in their public works.

3.3.2. Develop a Program to Track Annual Routine Maintenance, Repair and Replacement Needs and Provide Data to Assist in Allocating Capital Funds

A critical first step in assessing and prioritizing the City’s capital needs is to develop and maintain a system to track and assess the physical condition of facilities and infrastructure for all of the city’s public works. Improved data collection would allow departments to review reports for each of their capital assets, plan repairs and improvements, track work order requests, coordinate interdepartment and private utility projects (let’s only dig up the road once), project repair and replacement schedules and costs, and forecast capital expenditures based on future capital improvement plans and scheduled recurring maintenance as well as potential general obligation and revenue bonds. The Department of Public Works has begun the process of identifying the parameters and potential software applications for such a system. Off-the shelf software designed for this purpose is available, and has been used by other jurisdictions including, in a limited capacity, the San Francisco Unified School District. This effort should be funded, implemented, and maintained.

Initially, the condition assessment will require engineering analysis and cost estimating to build up the database as well as continuous updating to keep the information current. The information is essential in the development of a six-year capital plan and its annual update. This program should be funded from the budget set-aside recommended in this paper.

It is important to note that better information will not solve our capital maintenance problems if it is not also accompanied by adequate funding. The funding shortfall drives

3.3.3. Earmark a Portion of General Fund Support to the School District for Deferred Maintenance

In March 2003, voters approved Proposition H, which mandated up to $60 million per year of general Fund support for the San Francisco Unified School District. Although two-thirds of this support is allocated for specific programs by the ballot measure, one-third of the funds are not designated for a specific purpose, and can be used for any purpose designated by the school district. The school district currently spends a minimal amount of money for deferred maintenance, and in recent years has relied heavily on bonds to make major repairs to its neglected facilities. The Board of Supervisors and Mayor should work with the school district to earmark these monies for deferred maintenance, providing up to $20 million to the School District for upgrading the physical condition of its schools and other facilities. It is extremely difficult for the school district to allocate funding for capital projects at the expense of educational programs, and for good reason. However, these additional funds provided by the City present an opportunity to increase capital spending without cutting other programs. This investment in maintenance would save the district money on capital needs over time, and help improve learning conditions for students.

3.3.4. Clarify the Rainy Day Fund Capital Provision

In November, 2003, San Francisco voters approved Proposition G (which SPUR strongly supported), establishing a “Rainy Day Fund” to set-aside funds during times of budget growth. Half of the funds set-aside by the Charter Amendment will go to the Rainy Day Fund to be spent when the City faces revenue shortfalls. Another quarter of those funds must be used for “capital and other one-time expenditures.” This is an extremely sensible provision—since it is often difficult to fund capital projects during budget crises, it makes sense to ensure that funds are used for capital during good economic times. However, the wording of the Charter amendment could allow policy makers to get around the intent of the measure. The phrase “one-time expenditures” allows for an enormous amount of flexibility for how the funds would be used. In addition, even if the funds are used for capital, there is no requirement that they will be appropriated in addition to normally budgeted capital dollars. For example, if the Charter sets aside $10 million dollars through this provision, the mayor and board of supervisors can simply decrease the general fund allocation for capital and facilities maintenance by $10 million and spend the funds on other programs. In such a scenario, this provision would result in no net increase of capital funds. The requirements for capital funding in the Rainy Day Fund should be clarified to ensure the funds represent a net increase in capital investment.

3.3.5. Investigate Requiring Departments to Budget the True Costs of Maintenance

Over the long run, the City should explore moving to a real estate management model where the true costs of capital maintenance are reflected in departmental budgets. The Federal General Services Administration (GSA) could be a model for management and maintenance of city facilities. GSA “leases” space to Federal agencies. These agencies can choose to either use federally owned space or go into the private market. Therefore, GSA must be competitive with price and quality. Under San Francisco’s current system, departments often are not conscious of the full costs of the facilities they occupy, and are not required to pay them. Requiring City departments to pay lease expenses would make the “true” cost of program delivery visible. Property used by City General Fund departments could be maintained by the Department of Real Estate. The lease terms would designate a portion of the rent paid by departments for ordinary, recurring and deferred maintenance. A model of this nature would help make facility costs more visible as a regularly budgeted and important component of government service delivery.

endnotes

1 Based on San Francisco Department of Public Works, Draft Capital Expenditure Plan 2004-05 estimate of annual funding need, compared with capital and facilities maintenance budgets from San Francisco Consolidated Budget and Annual Appropriation Ordinance.

2 San Francisco Department of Public Works, Draft Capital Expenditure Plan 2004-05

3 San Francisco Department of Public Works, Draft Capital Expenditure Plan 2004-05

4 Phoenix actively involves as many as 200 citizens in priority setting, a process which has resulted in a high level of public confidence in the city’s capital-planning process and a nearly 100 percent approval rate for bond measures.

5 Dornan, Daniel L, GASB 34’s Impacts on Infrastructure management, Financing & Reporting. Infrastrucutre Management Group, June, 2000.

6 The DPW report covers the Academy of Sciences, Department of Administrative Services, Arts Commission, Emergency Communications Department, Fire Department, Department of Human Services, Juvenile Probation Department, Police Department, Department of Public Health, Public Libraries, Department of Public Works, Recreation and Park Department, Sheriff, Telecommunications and Information Services, Trial Courts, and War Memorial.

7 The DPW draft report estimates the replacement cost of its facilities by using the total number of square feet and a conservative construction cost of $350 per square foot. The $84.5 million figure is based on budgeting two percent of replacement costs, and would be higher if a higher percentage figure were used. More information on this method of estimating maintenance costs is available in: National Academy of Sciences, Committing to the Cost of Ownership: Maintenance and Repair of Public Buildings. Washington, D.C.: National Academy Press, 1990.