What happened: More than 4,220 units of housing began construction in San Francisco in 2012 — following a year in which just 269 net units were added.

What it means: After years of underbuilding, new housing and commercial construction is booming in San Francisco. Years of work on neighborhood plans and rezoning are paying off as new construction targets transit-served areas and neighborhoods that support greater residential density.

Walk down Market Street from the Castro Street Station to Powell Street Station, and you will pass more than 20 construction sites. These include small projects like the 24-unit condo building at 376 Castro all the way up to the 273-unit Avalon Bay project at 55 Ninth Street. The multiphase Trinity Project, stretching between Mission and Market on 10th Street, will eventually have 1,900 units. Meanwhile, the old Furniture Mart on 10th Street is being rehabbed into more than a million square feet of commercial space, and the financial services company Square is preparing to move into a 250,000-square-foot space in the old Bank of America data warehouse at 1455 Market. And this continues on almost every block of Market Street, all the way to Powell Street.

But Market Street is only one way to view the bigger trend. Twenty-two tower cranes dot the city. By year’s end, there will be 26. Many of these cranes are for public projects rather than private development, yet these numbers are staggering by any historic standards. Local union halls’ out-of-work lists are empty, and some unions are even calling in workers from other parts of the country. Something that seemed impossible not long ago is happening in San Francisco: a construction boom. But how did it happen so fast? Weren’t we just in a recession? Is it as big as it seems? What does it all mean?

How Big Is This Boom Really?

In 2011, $3.4 billion was spent on new construction, both public and private, exceeding the average of the previous 10 years by a billion dollars and outstripping the previous peak in 2005. All anecdotal evidence points to 2012 being bigger still for new construction expenditures. [1]

Halfway into 2012, more than 4,200 residential units were under construction in San Francisco. For context, this is 20 times the number of units that were added in all of 2011. All 4,200 won’t be completed this year, but many will, marking the beginning of a remarkable upswing in new housing construction.

An additional 32,120 new residential units have been approved by the Planning Department, and applications for another 6,940 units have been filed for review. [2] Nearly half of these represent the fully entitled projects at Park Merced, Treasure Island and Bayview/Hunters Point/Candlestick, whose construction will span several development cycles, and many of the approved units will never be built. But if the underlying conditions for this building cycle continue, some of the backlog of approved projects will be able to move forward into construction.

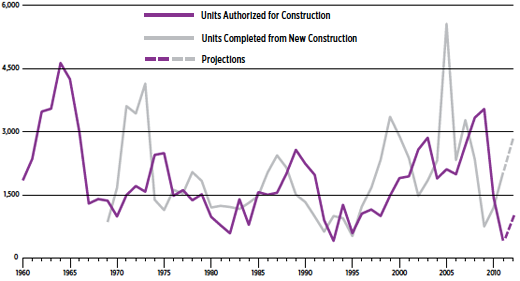

The graph on the following page demonstrates how spikes in permitting activity are echoed by spikes in new construction three to five years later. The last major jump in permitting was in 2007, and we are just now seeing the construction of many projects that were issued building permits then. The past two years also saw an increase in permitting activity (1,203 in 2010 and 1,998 in 2011, up from a low of 742 in 2009). The year 2012 is on track to sustain the upward trajectory. If the current construction uptick echoes preceding increases in permitted units, we may be looking at an unprecedented number of new units being completed over the next few years.

San Francisco Housing Permit and Construction Trends 1960–2012

San Francisco Planning Department. SF Housing Permits and Construction Trends 1960 - 2010. Teresa Ojeda (personal communication, October 22, 2012).

Residential construction often leads commercial activity by about a year. Although still in the early stages, a major increase in new office construction appears to be in the works. For the past year, as previously empty spaces have rapidly filled, developers have undertaken renovations and conversions to squeeze new space out of existing buildings. As fast as new space has become available, companies like Amazon, Yelp, Airbnb and Twitter have signed on, taking entire blocks at a time. Commercial vacancy rates have fallen below 5 percent in some neighborhoods,[3] and office rents across the city have increased 44 percent in just two years.[4]

While only one new ground-up office building (525 Howard Street) is currently under construction, projects totaling 3.6 million square feet are fully entitled and could break ground as early as the first quarter of 2013.[5] This is part of the 9.3 million square feet of office space the San Francisco Planning Department has in its pipeline, two-thirds of which is already approved.

One of the best ways to measure a boom’s depth and staying power is to survey developers, investors, lenders and seasoned observers. The data to demonstrate a peak is often available only after the fact, but surveys of developer sentiment make for strong predictions. And San Francisco is earning historically high marks in every indicator that forecasts development.

For three years in a row, measurable market sentiment has been optimistic about investment prospects in San Francisco.[6] San Francisco earned the triple crown from the Urban Land Institute’s Emerging Trends report for 2013 — winning designation as the top market for the investment, development and housing categories.[7]

Many of the cranes you see on the skyline today are for public projects like the Transbay Terminal, UCSF and other hospital renovations, but it’s clear that the private development market has taken off. What we don’t know is how many of the projects that are currently being talked about will actually be approved, or how many of the projects that are approved will actually get financing and be built. We also don’t know how long the conditions fueling this boom will last. Booms have a way of sowing the seeds of their own demise, as we will see below. But the verdict is clear: This really is a boom.

San Francisco is not the only city experiencing a construction bonanza right now. New York, Washington, D.C. and Boston are having their own as well.[8] But in a city that is famous for its opposition to new development, it is extraordinary that so many new buildings could be under construction in San Francisco at one time. What can explain it?

Causes of the Boom

Six major factors are helping to fuel this building cycle:

1. The supply-demand imbalance leads to soaring housing rents.

San Francisco rents have shot up drastically over the past year. Average rent for apartments of any size across the city has increased 7.6 percent in 12 months.[9] In some neighborhoods, rents have doubled over that same period.[10] On the supply side, over the past 20 years San Francisco has built about 1,500 units per year on average. But the city would have needed 3,000 to 5,000 units a year to allow supply to keep up with demand — a number that similarsized cities manage to provide. In 2011 housing production reached a historic low — with only 269 new units.[11]

High rents are bad for the people who have to pay them, but they also signal to investors and lenders that new apartment construction is justified by the projected returns. That means that developers can get projects financed.

Most of the units that went into construction in 2012 were rentals — reflecting in part the continued difficulty that would-be home buyers are having obtaining mortgages, as well as a possible reluctance to take on the burden of home ownership given the loss of value so many homeowners experienced in the great recession. It also reflects both the equity market’s preference for the much lower risk of rental products and the lack of willing lenders for condominium developments. Investors now believe that rental housing is significantly less risky than forsale condominiums, in part because revenues from condo construction are so dependent on hitting the market timing just right.

The rental housing boom is itself a surprising turn of events: For decades, most new market-rate construction in San Francisco has been for-sale housing. But most observers believe that the for-sale market is picking up steam, and they expect to see new condo starts increase in 2013. Many housing developers currently going through the process will decide at the last minute whether to go with rental or for-sale housing, depending on how the demand is trending.

A dramatic supply-demand imbalance that fuels rent spikes and a corresponding building boom is not a good strategy for a healthy, responsive housing market. It reflects a broken housing market where supply is unable to anticipate and react to rapid demand changes. For decades, San Francisco’s political environment has hindered new development. As a result, we have underbuilt housing, creating a longterm structural imbalance of supply and demand that the current building cycle will not come close to addressing. But the boom has the effect of attracting capital into residential construction right now, a first step toward righting the structural imbalance.

2. The tech boom increases the demand to live here.

Google, Apple, Facebook — many of the leading companies in the world — are located in the Bay Area, and they are growing. Capitalism is going through one of its cycles of change: Technology might be making all kinds of labor all over the world obsolete, as automation allows work to be more efficient but the people who sell the technology that enables that change are in great demand. The firms clustered together as Silicon Valley are strategically located in relation to the rest of the economy: What they have to sell is exactly what other sectors of the economy need during this time of transition.

A growing number of the major tech companies are located in San Francisco. These include Salesforce, Twitter, Square, Pinterest, Yelp and Airbnb. Employment in the tech sector in San Francisco grew by 13,000 jobs between 2010 and 2012 to reach a total of 41,000 jobs this year,[12] exceeding the number of jobs created by the previous dot-com boom.[13] This growth in tech employment is the direct cause of the demand for new office space. As employment in San Francisco’s tech sector has jumped 42 percent over the last two years, average office rents in the city have increased 44 percent, a number that only begins to be matched by the Peninsula’s increase of 31 percent.[14] Nowhere else nationally comes close to this kind of growth: When the Bay Area is excluded from the sample, average office rent growth among U.S. cities is less than 1 percent.

But in terms of residential demand, it doesn’t matter whether the jobs are in San Francisco or Mountain View. A large part of the employee base — more than a third of Google’s employees, for instance — want to live in San Francisco, even if that means a long commute. Google, Yahoo, Apple, eBay, Genentech and Facebook operate shuttles that transport more than 14,000 people per day from San Francisco to their corporate campuses on the Peninsula.[15]

It’s important to remember that employment in the “basic” sector of the economy — the externally oriented sector that sells goods or services to people who live elsewhere, of which tech is a part — accounts for only a fraction of any community’s overall employment. Typically, each job in the basic sector supports two to three other jobs in the nonbasic, local-serving sector. So the people who give haircuts, sell groceries, remodel homes, provide legal services and teach yoga classes are experiencing job growth as well.

Will the current crop of tech companies last? If history is any guide, most will not, but some that do will grow into big, important companies. In any case, San Francisco’s economic fortune is now intertwined more than ever before with the broader trajectory of Silicon Valley as an innovative economic cluster.

The tech boom is compounded by demographic shifts in living preferences. Young people are flocking to cities with highly educated and innovative workforces, good transit and walkability ratings and diverse cultural offerings. The young people who work in tech largely prefer renting to owning and are comfortable in smaller units, provided that these apartments come with access to urban amenities. Even if the tech industry’s growth cannot be sustained, the impact of the “echo boomer” generation coming of age will continue to drive construction of multifamily residential in the urban core.

3. With recession in much of the world, the Bay Area provides a standout investment opportunity.

One of the unusual dynamics of this construction boom is that it is so geographically concentrated. While the Bay Area technology sector is booming and generating spin-off demand growth in cities within the Silicon Valley orbit, much of the rest of the world is in economic contraction. There are few places investors can go to put their money to work.

Investors are willing to invest, lenders are willing to lend and developers are willing to develop if a project is financially viable. Right now, residential rents in San Francisco are high compared to the costs of development. As a result, the projected profit of an apartment project is sufficient to attract both equity and debt. (Debt is a loan that has to be repaid over time. Equity is an investment that gives the investor an ownership in the project. Equity is riskier, and therefore requires a larger return.)

If rents drop, construction costs increase substantially or the city imposes substantial new impact fees, this projected profit margin could disappear and new apartment construction could ebb. For now, though, apartment proformas in San Francisco are healthy enough to support new construction.

From an investor’s perspective, San Francisco has the added benefit of being chronically and severely undersupplied in rental housing. Despite the recent boom, the city’s housing stock remains tens of thousands of units short of meeting demand — and it is extremely unlikely that supply will ever catch up. As a result, San Francisco is somewhat cushioned during downtimes. Even during a recession, demand will likely continue to outpace supply, and rents will not drop as steeply as they might in other parts of the country. San Francisco is a safer place to invest in an apartment building and thus is considered a “core” residential real estate market.[16]

Given San Francisco’s status as a core residential market and the general lack of opportunity to purchase an investment-grade apartment project, institutional investors are now attempting to expand their footprint in the San Francisco market by “building to core.” Institutional players are developing projects themselves or entering into agreements to purchase buildings as soon as construction is complete.

With interest rates in the broader national and international economy being so low, but with so much rent escalation here in San Francisco, investors are — for the moment — trying hard to get into this housing market. However, as so many investors and lenders lost money in the last real estate bust, they continue to be cautious about financing projects in San Francisco, and developers still report having a hard time raising money.

The peculiarity of being in a boom while most places are in recession adds fuel to this wave of construction.

4. Construction costs have been contained.

During the recession, contractors had to lay off many of their employees. Eventually, they got to the core staff, the people with specialized knowledge who make their firms work. Contractors were willing to lose money on jobs in order to retain their core staffs, and construction bids were driven through the floor.

Put another way, competition between contractors for a shrinking pool of work drove down construction costs. This helped restart construction again by making some projects on the margins financially viable.

As the boom proceeded throughout 2012, construction costs began to climb quickly, and by the end of the year there was no longer a cost savings to be had. As

the boom continues and the demand for construction (both labor and materials) i

ncreases, construction costs are rising and actually starting to become a constraint on new development.

5. We have a legacy of previous planning work.

Moving away from market dynamics to the realm of policy, we arrive at the astounding amount of planning work that has been completed over the last decade, which paved the way for the current projects.

Consider the opening example of upper Market Street: Almost all of the major sites under development between Castro and Ninth streets lie within the boundaries of the Market and Octavia Area Plan. SPUR worked on this neighborhood rezoning for more than a decade, putting thousands of hours into it and at times wondering if our efforts were worth it. Eventually the Market-Octavia Plan went through a programmatic environmental impact report (EIR), allowing projects that are consistent with the plan to undergo a streamlined environmental review. More important, we built a rough consensus among all the participants in the planning process about where and how new growth should be directed into the neighborhood. (For example: Put it on Market Street, not the residential side streets.) All of that work is manifesting itself in the wave of infill buildings that are going up on former parking lots and gas station sites up and down the street.

The Rincon Hill, Mission Bay and other neighborhood plans also created the zoned capacity for the projects we are now seeing. Not all the neighborhood plans were successful, however. Some ended up down-zoning along transit corridors as the Eastern Neighborhoods plan did around the Mission Street BART stations. Others, like the Transit Center District Plan, took so long that they were only just completed at the end of this year. But overall, successfully completed neighborhood plans represent a bright spot in the San Francisco planning and development world, laying the groundwork for the current construction boom.

6. There’s been a change in political attitudes.

During the recession, a lot of projects got approved as the normal anti-growth culture was suspended for a couple of years. The growth wars became less of an issue in public discourse. People started to want investment, and supervisors took controversial votes to try to restart investment in the city.

Some of those votes will not generate construction for a long time. This is true of the three megaprojects that were approved last year — Hunters Point, Park Merced and Treasure Island — each of which will take decades to complete.

But other projects are moving forward right now. In the Upper Market neighborhood alone, half a dozen properties approved during the downturn are under way, including the 114-unit LGBT Center site at 1844 Market Street, entitled in 2007; 2200 Market, a 22-unit project entitled in 2008; 2001 Market, 85 residential units with a ground-floor Whole Foods, entitled in 2010; and the “hole in the ground” site at Market and Noe, slated for 18 units, approved in 2010. All began construction this year.

Will the Boom Continue?

The boom’s trajectory depends on how all of these factors play out. One unknown is how long the tech industry’s growth will last. Another is how long interest rates will stay low. This depends largely on what happens in the rest of the global economy, including what the U.S. Federal Reserve Board does with its rate-setting authority in the coming months.

These two questions — what will happen with broader employment in the Bay Area and what will happen to the cost of capital — are somewhat inversely related: If the global economy gains strength, that will support continued job growth and wealth creation, likely to be good for companies in the Bay Area and to mean continued growth in numbers of people who want to live here. On the other hand, it will mean capital has more outlets, more places to invest, so the cost of borrowing money to build buildings will go up. If the global economy gains strength, that could also lead to cost escalation for materials and labor, especially if more cities in the United States begin to build.

If the boom keeps going long enough, we can expect that prices will rise — for labor, materials and land — and this will begin to choke off projects. At the same time, we can expect that housing rent increases will level off, as new supply comes on the market. And finally, we can expect that an anti-growth backlash will kick into high gear — and supervisors will become less willing to approve projects. The growth wars will once again become the major topic of political debate. People will run for office and start to win on anti-growth platforms. Fees on development will get raised.

But the larger factors driving the boom are not local and are not policy-related. Capitalism has always had a boom-bust cycle. As long as we have this economic system, we are in for this roller-coaster ride. We know a downturn is coming; we just don’t know exactly when or how rapidly it will occur.

SPUR had a lot to do with creating the climate for this construction boom. We worked on Mission Bay, Market-Octavia, Rincon Hill and other plans year after year. We fought for the zoning and the political climate that would enable things to be built.

The work of rezoning a neighborhood often takes more than a decade. Once the zoning is in place, it can take many more years for the stars to align so that projects can be built. The real work of making walkable infill development happen is slow and messy.

Each wave of development leaves a legacy. The projects that are built will either move us closer to or farther away from sustainability. They will either contribute positively or negatively to the public realm. They will make the city more inclusive or less. Time will tell what kind of legacy this building cycle leaves, but we are optimistic. The buildings were not fast-tracked in any way — far from it. They have undergone intensive design and approval processes in order to get through the notoriously difficult San Francisco entitlement system.

SPUR’s role is to put in place the conditions that facilitate positive growth, and we are set up to stay with this work for the long haul. There is a lot more to be done: new neighborhoods that need intensive planning work and many regulatory problems that need to be sorted out. But it’s nice to see so many years of hard work paying off with some good projects, and it’s nice to see San Francisco supporting well-designed, well-located development.

Planning is about being proactive rather than reactive. We are working now to lay the foundations for the next cycle of growth.

--

[1] San Francisco Planning Department, 2011 Commerce & Industry Inventory (November 2012), p. 83.

[2] San Francisco Planning Department, San Francisco Pipeline Report Q2 2012 (September 2012), p. 3.

[3]

SocketSite, “San Francisco Office Outlook Vacancy Rates and Rents” (August 7, 2012)

[4] CRBE Global Research and Consulting, US Tech Twenty Office Report 2012 (August 2012), p. 2.

[5] Jones Lang LaSalle, 2012 San Francisco Office Development Overview.

[6] Allen Matkins/UCLA Anderson Forecast, California Commercial Real Estate Survey 11 (Summer/Fall 2012).

[7] PricewaterhouseCoopers and the Urban Land Institute, 2013 Emerging Trends in Real Estate (October 2012), p. 32.

[9] RealFacts Inc., “Rental Trends: City of San Francisco, All Classes, Quarter

ly Trends” (November 7, 2012).

[10] Sally Kuchar, “The Bad News: As Suspected, Rental Rates Have Increased Dramatically Over the Past Year,” Curbed SF, May 14, 2012,

curbed

[11] San Francisco Planning Department, San Francisco Housing Inventory (May 2012), p. 6.

[14] CRBE Global Research and Consulting, US Tech Twenty Office Report 2012 (August 2012), p. 2.

[16] Another factor that drives up demand for investment in San Francisco apartment buildings is the scarcity of large-scale, investment-grade projects. Real estate investment trusts (REITs) and institutional players like Avalon Bay, BRE, Essex, Archstone and UDR typically need “quality” projects in excess of 200 units to fit within their investment parameters. San Francisco has relatively few apartment buildings that meet this definition, and it is extremely rare for those few buildings to be offered up for sale.