Since the passage of Prop. 13 and the subsequent rounds of legislation at the State level, communities across California have tried to figure out alternative ways to fund the public realm. One of the most common methods is to charge “impact fees.” Especially in growing suburban communities‘ land owners who develop residential have been required to pay for the expansion of roadways, sewer systems, schools, and parks needed to support the residential development.

San Francisco instituted an impact fee on office development in 1985. The so-called “Jobs-Housing Linkage” fee was originally set at $5.00 per square foot of office development and later ratcheted up to $11.34 per square foot. But until 2002, aside from a very modest school impact fee, the City intentionally did not levy significant impact fees on residential development for two principal reasons. First was the desire to encourage more housing to get built by not adding to its cost. Second, it is inherently more efficient in terms of infrastructure costs to build inside an already urbanized area than to build on “greenfield" sites on the urban periphery, where great lengths of piping and paving would have to be put in place to provide services. Preexisting infrastructure is one reason for the much higher land costs in cities. San Francisco’s policy 2002 was to generate funding for public-realm improvements from the property and sales taxes that come from added residential development, but not from any added upfront costs to residential development.

All of this changed with the codification of San Francisco’s inclusionary housing law in 2002. This law required all new market-rate housing developments of 10 or more units to provide between 10 and 17 percent of the units at below market rates. (The exact percentage required depends on whether the project needs a conditional use permit or not and whether the units are built on-site or off-site.) Whereas the preexisting school impact fee was $1.72 per square foot of development, the inclusionary housing fee imposes an additional estimated $42 to $54 per residential square foot on a for-sale project in Rincon Hill.1

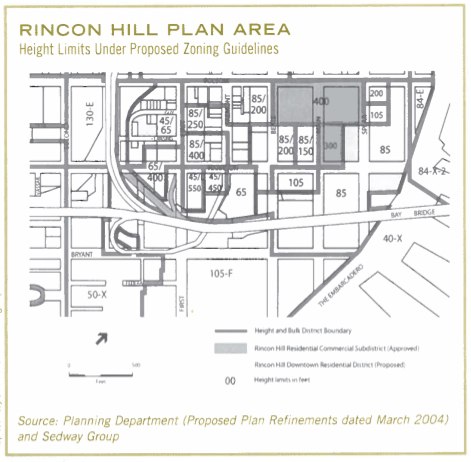

The Rincon Hill Plan encompasses about 10 blocks. It lies just to the north of South Beach and just to the south of the Transbay Terminal Redevelopment Area. Along with these other neighborhoods, Rincon is undergoing a dramatic transformation from a largely underutilized industrial area to a high rise residential neighborhood within walking distance of downtown and the waterfront. The challenge for the Rincon Hill Plan is to put in place a framework for development that will create all the amenities, from comfortable pedestrian streets to places to go shopping, that will make it a great San Francisco neighborhood.

SPUR originally proposed that the City enact its inclusionary housing “policy" into legislation in September 2000. The goal was to provide a predictable inclusionary housing requirement in order to provide developers, land owners, investors, and neighborhood activists with certainty— replacing last-minute negotiations at the Planning Commission or Board of Supervisors.

SPUR was criticized for promoting a program that added costs to housing construction at a time when we needed to increase housing production significantly. When you make something cost more, you usually get less of it.

Summary Residential Land Value Analysis: Multifamily Rental Development

| Mid-Rise, Proposed Zoning 109 Units | High-Rise, Existing Zoning 219 Units | High-Rise, Proposed Zoning 395 Units | |

| Annual Net Operating Income | $2,035,574 | $4,244,543 | $8,358,241 |

| Return on Cost* (Capitalization Rate) | 8.00% | 8.25% | 8.50% |

| Warranted Investment ** | $25,444,673 | $51,449,006 | $98,332,247 |

| Direct Development Costs | 25,569,750 | 56,170,020 | 97,837,640 |

| Indirect Development Costs | 6,251,097 | 15,927,450 | 30,167,059 |

| Less Total Dev. Costs Excluding Land | $31,820,847 | $72,097,470 | $128,004,699 |

| Total Residual Land Value | ($6,376,172) | ($20,648,464) | ($29,672,452) |

| Residual Land Value Per Unit | ($58,497) | ($94,285) | ($75,120) |

*annual return needed to entice a developer to undertake the risk of building and leasing a new project

**the total amount a prudent investor would invest in a project the projected annual net operating income of which would yield the required annual return on cost (the required return on cost increases as the development becomes larger and taller, and thus entail greater risk due to greater capital outlays and longer absorption periods)

Source: Webcor, Pankow, Planning Department, SPUR, and Sedway Group.

Under current market conditions, multifamily rental development in Rincon Hill is not feasible and cannot support an impact fee. Each of the rental prototypes generated a negative residual land value. Further, even with a 20 percent increase in the average monthly rental rate for market-rate units, the residual land values generated by prototypical multifamily rental development in Rincon Hill remain negative and cannot support an additional impact fee to fund community improvements. This is supported by historical development trends in Rincon Hill, in which only one rental project (Avalon Towers) has been built. There may be certain exceptional conditions in which a rental project can be built in this neighborhood, and conditions may change in the future, but in general Sedway Group is doubtful that multifamily rental development in Rincon Hill can support an impact fee.

SPUR’s defense of inclusionary housing is based on two ideas:

First, the inclusionary housing law was presented as a package of reforms that were designed to create certainty in the process of developing housing. These reforms included far-reaching rezonings to move away from a “conditionally permitted” planning system toward an “as-of-right” planning system. The logic we proposed was that if a project fits with local zoning then it should be encouraged, and if it doesn’t fit it should not be allowed—which as planning insiders know could not be farther from the environment of dealmaking and politicization that has evolved in San Francisco. We worked for several years to build a coalition that would pass these various measures as a package deal. But ultimately, we lost this battle: the measures were unbundled, and to this day the reforms to create greater certainty have not happened. Had the original deal gone through, the greater level of certainty afforded developers would have lowered the risk of development, enabling housing builders to borrow money at lower interest rates, which would have partially mitigated the added costs of the inclusionary requirement. The reform effort remains incomplete.

Second, SPUR believes that exaction fees on residential development are an acceptable form of public financing up to a point. These fees do not necessarily raise the prices of the units or reduce the total amount of development that takes place, because of the special nature of real estate economics. Land price is not fixed in the same way that other “inputs" into a production process are. It is determined by the value of what can be built on it, less the costs of construction (it is a “residual” value). If fees are added onto a development, and the amount of the fees is known well in advance, those fees translate into a reduced land price. Contrary to the popular myth, developers cannot generally pass on the costs of fees to future residents. As rational market actors, developers are already charging the maximum rent or purchase price the market will bear. If prices go up, then potential residents “substitute” a different project or community and live somewhere else. If developers know about the fees before they enter into a deal, they deduct the fees from the price they bid for the land. (If unanticipated fees are imposed later, investors in the project lose money.) As long as the costs of the develop1nent fees are predictable in advance, development fees function like a “tax” on landowners even though they are not considered a tax for legal purposes under California law. Development costs—such as those incurred in fulfilling inclusionary-housing requirements—are not passed onto consumers (because developers are already charging the maximum the market will bear), and fees don’t reduce profits (because if profit margins for the project are too low to attract investors, the project is simply never undertaken). Fees come out of the land price. Up to a certain point, additional fees do not have a significant effect on the amount of development.

Nevertheless, there is a limit to how high exactions can go. The higher the fees, the less the developer can afford to pay for land; the lower the land price, the less willing a landowner is to make the land available for new development. If developer fees get too high, they reduce the amount of land that will he brought into development. Landowners will instead keep surface parking lots or low density retail buildings or whatever use happens to exist. We argue that it is acceptable to fund public improvements with fees on housing development as long as the levels of the fees are right.

SPUR commissioned the Sedway Group to do a study on the question: how much can be charged in impact fees on Rincon Hill as part of the new plan being developed by the Planning Department, before the fees significantly reduce the amount of residential development that takes place?

The study analyzed the Draft Rincon Hill Plan published in November of 2003. In that plan, the Planning Department proposed developer exactions as a way to pay for public amenities such as a park, a library, a community center, or extra-wide and landscaped sidewalks, to make the area into a desirable residential neighborhood.

With the help of a technical advisory group, as well as the services of construction contractors who served as cost estimators, the study was completed and released by SPUR in November 2004 (and available online at www.spur.org).

The study’s core methodology (technically called a “static” land-residual analysis) can be distilled down to three parts:

- Estimate the revenue that will come from a housing project on a prototypical site built under existing and proposed zoning controls, either net sales proceeds in the case of ownership housing or net operating income (rents minus expenses) in the case of rental housing.

- Estimate the costs of building the housing. These costs include construction, financing, design, and everything else necessary to make the project exist, but not including land costs.

- Subtract the costs from the revenue. Whatever is left is the residual land value (i.e. the amount that could be paid for the land and still make the project financially feasible.)

By comparing the residual land value with the land prices in Rincon Hill and other competitive areas it can be determined additional developer fees are feasible. If residual value is greater than land prices, then the additional fees can to that extent be imposed provided there is enough incentive left for the developer to undertake the development and for land owners to sell land to developers.

Among the study’s main conclusions are these:

The new plan for Rincon Hill would decrease the number of units that are likely to be built by 513 units (from 2,016 down to 1,503). This is largely because of the urban design goals of having widely spaced towers.

Rental development generates negative residual land values under both currentand proposed zoning. It is not economically feasible to create rental projects, at least not given the construction types that are appropriate in Rincon Hill. This finding is consistent with the fact that very little market-rate rental housing is being built in the city, although there are certain exceptions mentioned in the report that would make rental housing possible.

Ownership developments generate positive residual land values ranging from $50,000 perunit for mid-rise, $65,000 per unit for high-rises under existing zoning, to $76,000 per unit for high-rises under the proposed zoning. This tells us that market-rate ownership development is feasible in Rincon Hill and can support an additional impact fee on top of the school fee and inclusionary-housing requirements. The proposed zoning increases land values on sites that will he allowed to have high-rises by about $10,000 per unit over the current-zoning values. Sedway Group conducted a sensitivity analysis for the high-rise proposed-zoning scenario and found that an impact Fee of $9.00 per square foot resulted in a residual land value that was roughly equivalent to that under the existing zoning with no impact fee.

The study recommends setting development impact fees no higher than $5 per square foot. This essentially splits the potential impact fee indicated by the sensitivity analysis of approximately $9 per square foot between landowners and the City, maintaining an incentive for landowners to take advantage of the upzoning and bring land into development. This fee is in addition to the existing school fee ($1.72/sq. ft.) and the cost of meeting the inclusionary housing ordinance ($42-$54/sq. ft.).

Summary Residential Land Value Analysis: Multifamily For-Sale Development

| Mid-Rise, Proposed Zoning 91 Units | High-Rise, Existing Zoning 182 Units | High-Rise, Proposed Zoning 329 Units | |

| Total Gross Sales Proceeds | $50,457,919 | $114,894,258 | $219,184,256 |

| Threshold Gross Profit Margin* | 20% | 25% | 30% |

| Warranted Investment** | $42,048,266 | $91,915,406 | $168,603,274 |

| Direct Development Costs | 26,135,220 | 53,040,061 | 91,228,362 |

| Indirect Development Costs | 11,405,118 | 26,934,476 | 52,390,514 |

| Less Total Dev. Costs Excluding Land | $37,540,338 | $79,974,537 | $143,618,876 |

| Total Residual Land Value | $4,507,928 | $11,940,869 | $24,984,398 |

| Residual Land Value Per Unit | $49,538 | $65,609 | $75,940 |

*The expected development profit (based on development costs) that a project must show in order to obtain financing

**The total amount a prudent investor would invest in a ownership project the projected gross sales proceeds of which would yield the required gross profit margin. (The gross margin for high-rise is greater because of the additional risk associated with the longer construction and absorption periods.)

Source: Webcor, Pankow, San Francisco Planning Department, SPUR, and Sedway Group

The current market generates positive residual land values for multifamily ownership housing for mid-rises and high-rises, under both the current and proposed zoning. Both the “High-Rise, Existing Zoning," and “High-Rise, Proposed Zoning" scenarios produce land values per unit above the $50,000 benchmark that represents the low end of actual land transactions within the area for entitled sites. The High-Rise, Proposed Zoning scenario would increase the residual land value per unit by about $10,000 over the High-Rise, Existing Zoning scenario. Sedway Group believes, therefore, that development under the proposed high-rise zoning guidelines can supportfee. The report recommends setting the impact fee at $5 per square foot of development.

Looking at a range of possible funding mechanisms for public realm improvements, the study finds that both Community Facilities District (Mello-Roos) financing (which would impose annual special taxes on property within the district) and impact fees are potentially feasible. Financing through a Community Facilities District would shift the timing of the payment of fees to later in the development cycle (after the units are occupied), which means that projects do not have to pay the fees with expensive investment capital.2 In addition, bonds can be issued against anticipated tax revenues, enabling the facilities to be provided sooner—whereas, with fees, the facilities would have to be phased in as development occurs.

With any luck, the Rincon Hill Plan will be adopted in early 2005. We hope this study can help inform the public debate around the plan. We believe this kind of analysis should be done as part of every neighborhood-planning effort that contemplates significant upzoning, so that the economic benefits of future upzonings can be split between the landowners (thus inducing them to sell their land to developers) and the public. Every neighborhood will have its own set of priorities, whether that be enhanced transit service, more-affordable housing, or new parks. The planning process provides an opportunity for calculating both how high exactions can go and for making decisions about the priorities for spending the exactions. All of this can be done in a way that creates greater certainty in the development approval process and greater funding for public realm improvements, leading to both increased housing opportunities and stronger neighborhoods.