The votes are (mostly) in at the close of a historic election season. In the midst of the national presidential race and consequential state-wide ballot measures, Bay Area voters weighed in on a range of local measures, including a number of new or extended sales taxes to fund local services. They’re a common revenue-raising tool, made all the more appealing as the COVID-19 pandemic creates desperate budget shortfalls for cities and counties across the region.

But sales taxes continue to play a role in reinforcing structural inequality in the Bay Area and across the state. California’s 7.25% state sales tax rate is the highest in the nation and is driving the overall tax burden on low-income households. (In fact, low-income Californians pay over 10% of their income in total taxes — a higher share than their counterparts in 28 other states.)

The Financial Impact of Sales Taxes Varies by Income

Reconsidering a Time-Honored Funding Tool

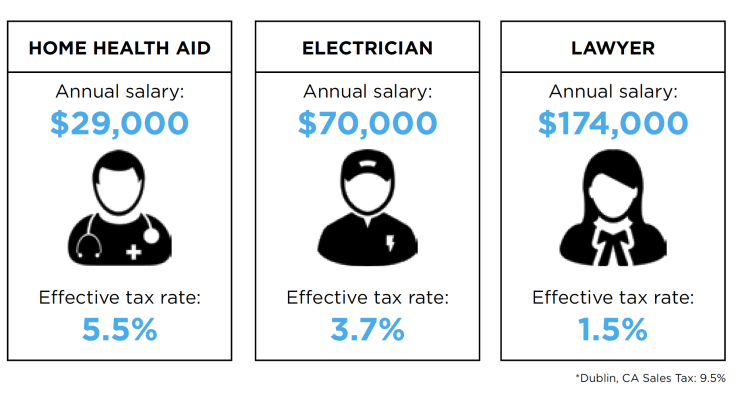

Sales taxes are notorious for their regressive impacts: Every consumer pays the same tax rate at the register, but low-income households pay a higher percentage of their income because they have fewer resources to begin with. This erosion of financial security hits the thousands of Bay Area households living paycheck to paycheck, particularly Black households and other households of color who are overrepresented at the low end of the income spectrum. The lowest-income households pay over three times what their wealthier counterparts pay as a share of income.

SPUR has long advocated for and supported sales taxes to fund public services, particularly transportation. We acknowledge that in doing so, we have helped perpetuate their inequitable impacts. After much debate, SPUR decided to support two such sales taxes on the ballot this election. We supported Measure RR to raise critical revenue for Caltrain, encouraged by the agency’s new equity framework and commitment to equitable service planning and fare reform. And we supported Alameda County’s Measure W, balancing our concerns about the revenue source with the opportunity to raise funding for programs that serve the urgent needs of unhoused Alameda residents. In California today, sales taxes are not designed to mitigate for disparate impacts on people with low incomes. Until tax proposals begin to incorporate relief for low-income people, it will be an ongoing challenge to weigh the benefits of revenue generation against the downsides of inequitable tax burden.

A New Approach: Creating a More Equitable Tax Code

As supporters of taxation for the public good, we take responsibility for better understanding the impact of sales taxes and helping to promote policies that mitigate their inequitable impacts. Our new briefing paper Undue Burden: Reforming Bay Area sales taxes explores the cumulative financial impact of state and local sales taxes on households in the Bay Area (the analysis covers sales tax rates as of April 2020). While other methods of sales tax reform are worth further study, we offer policy and implementation options for one category: creating a sales tax credit or supplement for low-income Bay Area households. Tax credits and cash benefits provide both immediate and long-term opportunities to put money back in the pockets of low-income households. These are straightforward, targeted and effective policies to provide relief from the region’s high sales taxes and advance a more just tax code.

Instituting a tax credit or supplement could take several different forms. The paper explores three options:

Create a Sales Tax Fairness Credit

Tax credits are considered one of the most effective tools for building financial security for low-income working households. The most well-known is the earned income tax credit (EITC), which provides certain low-wage households with a credit toward their annual income tax liability that can be claimed by filing a federal tax return. Similar to federal and state earned income tax credits, a refundable sales tax credit can return money paid in sales tax to low-income people. Such programs already exist in other states. Those who qualify to receive the credit would apply for it through their annual tax return and would receive a credit amount designed to fully offset the money they pay in sales tax throughout the year (the credit would also increase depending on family size). A regional entity and the state Franchise Tax Board, which currently administers the California Earned Income Tax Credit, could be given authority by state legislation to jointly administer the credit. Absent a regional entity, the Franchise Tax Board could build off other existing models in the U.S. by establishing contracts with Bay Area county governments.

Create a local sales tax supplement at the county or sub-county level

In this option, a taxing jurisdiction (like a county or city) could set aside a portion of revenue from any future new sales tax, tax increase or tax extension to fund a Sales Tax Fairness Supplement. The supplement could be designed to offset the additional burden of the new or extended sales tax on low-income residents within that jurisdiction. To make administration easy, it could be structured as a flat cash amount, regardless of household size, and the income eligibility requirements could match that of the California Earned Income Tax Credit. This would allow the supplement to be automatically distributed to eligible households without the need to apply.

Create a local sales tax cash benefit at the county or sub-county level

Another option for more immediate action would be to create a locally funded and locally administered cash benefit. Structured as a flat cash amount, this benefit would be designed to offset the burden of local sales taxes. It would be administered through county social services agencies and designed to match eligibility requirements for other benefit programs implemented at the local level. Eligible households would either automatically receive the cash amount when they qualified for other benefits, or they would fill out a simple form. Local governments could pass legislation to create the benefit and fund it from their general fund or other local revenue, adjusting the total amount year to year.

If taxes are more than revenue-raising tools — if they reflect our collective sense of fairness and shared values — then we must reimagine our approach to sales tax. A sales tax credit or similar cash benefit is one tool that Bay Area governments can use to address the impact on low-income households, and to advance a more just tax code and a more equitable region.