What the Measure Would Do

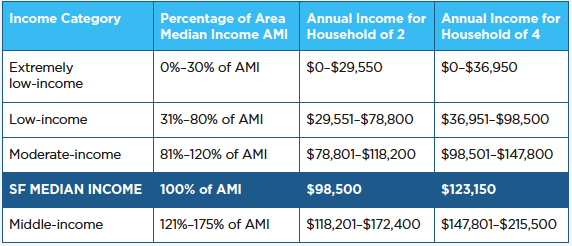

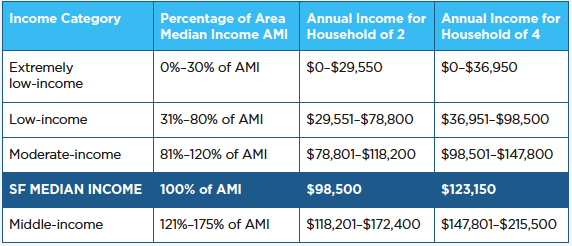

Prop. A would authorize the city to issue $600 million in general obligation bonds to fund the construction, development, acquisition, rehabilitation and preservation of affordable housing for extremely low-, low-, moderate- and middle-income households. See Figure 1 for examples of these household incomes, which are defined as a percentage of area median income (AMI).

The measure would provide:

- $220 million for the construction, acquisition and rehabilitation of low-income housing, including supportive housing for households earning between 0% and 80% of AMI.

- $150 million for the repair and rebuilding of distressed public housing, which serves households earning between 0% and 80% of AMI.

- $150 million for the creation of senior housing for households earning between 0% and 80% of AMI.

- Up to $30 million for the preservation of existing affordable housing (serving households earning between 30% and 120% of AMI) that is at risk of physical decline or conversion to market-rate housing.

- At least $30 million to assist in the creation of housing opportunities for middle-income households earning between 80% and 200% of AMI, such as site acquisition for new housing developments or individual down-payment assistance programs.

- $20 million for predevelopment and construction of housing for educators making between 30% and 140% of AMI.

The bond is expected to create more than 1,600 housing opportunities, including new units, rehabilitated or replacement units and direct household assistance. The city has also set a goal to direct $200 million of the bond toward serving extremely low-income households (those making up to 30% of AMI).

An existing citizens’ oversight committee would audit use of the bond funds annually.

Based on the city controller’s estimates of the cost to fund the bond, the highest estimated annual property tax increase for the owner of a home with an assessed value of $600,000 would be approximately $102.76. Because San Francisco has a policy of only issuing new bonds as older ones are retired, this bond would not increase property tax rates above 2006 levels.

As a general obligation bond, this measure requires a two-thirds vote to pass.

Figure 1. Who Does Affordable Housing Serve in San Francisco?

Affordable housing projects and programs subsidize the cost of housing for groups that cannot afford market-rate rents or home prices. The definitions of extremely low-, low-, moderate- and middle-income households are determined by the U.S. Department of Housing and Urban Development and vary from city to city based on the area median income (AMI). Housing is considered “affordable” if it costs less than 30% of a household’s income.  Source: San Francisco Mayor’s Office of Housing, https://sfmohcd.org/sites/default/files/ Documents/MOH/Asset%20Management/2019%20AMI_IncomeLimits-HMFA.pdf

Source: San Francisco Mayor’s Office of Housing, https://sfmohcd.org/sites/default/files/ Documents/MOH/Asset%20Management/2019%20AMI_IncomeLimits-HMFA.pdf

The Backstory

San Francisco is experiencing a well-documented housing affordability crisis. The city is reported to have the highest median rent in the country and a median home sales price of $1.35 million. Homelessness is up 30% from two years ago, and not only low-income but also moderate- and middle-income households are finding it difficult to remain here because of the high cost of living.

Today, San Francisco has many different sources of funding dedicated to affordable housing, including impact fees, federal grants, the General Fund, the Housing Trust Fund, the 2015 affordable housing bond and others. But nearly all of these sources are committed to affordable housing projects that have already been proposed. Many unfunded projects are awaiting a future source of funding, such as this bond, in order to come to fruition.

As a result, officials and housing advocates have been pushing to put an affordable housing bond on the ballot in recent years. Through the capital planning process, San Francisco schedules in advance when most general obligation bonds will come to the voters. Unlike other capital needs (such as parks and open space, earthquake safety, emergency response, transportation, public health and seawall safety), affordable housing has not been regularly incorporated into the calendar.

In January, Mayor London Breed proposed a $300 million affordable housing bond for early 2020, alongside an earthquake safety bond for November 2019. She also proposed adding affordable housing to the capital plan bond schedule going forward (a change that is still pending). Over several months of negotiations among the mayor, Board President Norman Yee, other supervisors and advocates, this bond was pushed up to this November (instead of the earthquake safety bond), increased to $500 million and then finally increased to $600 million. All 11 members of the Board of Supervisors are now co-sponsors of the measure, which would be the largest affordable housing bond in San Francisco’s history.

The uses of the bond, outlined in a report separate from the actual measure, were identified by a large working group that included affordable housing developers, housing and development experts, elected officials, tenant advocates, and members of the philanthropy and business communities.

This measure was put on the ballot by a unanimous vote of the Board of Supervisors.

Pros

- Prop. A would substantially add to San Francisco’s affordable housing stock through new construction and preservation efforts.

- By adding newly built affordable housing, this bond would also increase San Francisco’s overall housing supply, which would help moderate prices at all levels of the housing market.

- This bond would help complete the repair and rebuilding of two of San Francisco’s most distressed public housing developments through the HOPE SF initiative.

- Several projects in the development pipeline that are currently on hold would be able to move forward with the passage of this measure.

- The bond would address the needs of households across the income spectrum, including educators, but would also maintain a commitment to meeting the needs of San Francisco’s most vulnerable residents, including seniors, people with chronic mental illness and people struggling with substance abuse.

Cons

- While this is the largest affordable housing bond in San Francisco’s history, it is not sufficient to address the full scope of the housing crisis.

Source: San Francisco Mayor’s Office of Housing,

Source: San Francisco Mayor’s Office of Housing,