OAK

Measure

T

Progressive Business Tax

Progressive and Equitable Business Tax

Creates a tiered tax system in Oakland based on businesses’ gross receipts and their business sectors.

Vote YES

Creates a tiered tax system in Oakland based on businesses’ gross receipts and their business sectors.

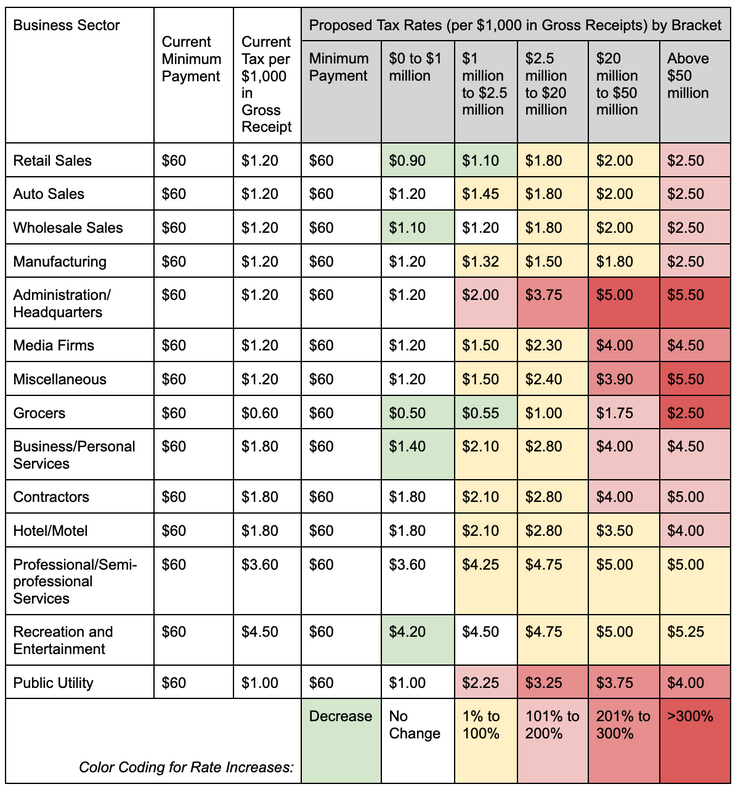

Measure T would establish a system to tax businesses by gross receipt amount and by business sector. “Gross receipts” refers to the total revenue a business brings in before any costs or taxes are deducted. The measure would create six tax brackets with 14 business sector categories.

The vast majority (90.9%) of businesses operating in Oakland would see no change to their taxes or a very small tax cut (average tax cut of around $100). The other 9.1% of businesses operating within Oakland would see tax increases. The size of the increase would vary by business sector and gross receipts, but in general, the larger the business, the higher the tax increase. Measure T would effectively raise taxes for Oakland’s biggest businesses while slightly lowering taxes for many small businesses.

The revenue raised by the measure would go to the city’s General Fund, which would help Oakland pay for functions of city government, including homelessness services and housing, street and sidewalk maintenance, trash collection, small business assistance and more.

Since 2005, Oakland has operated under the same flat gross receipts tax system, which charges all businesses the same tax rate regardless of the size of their revenue. In fiscal year 2019–2020, Oakland had 53,313 tax-paying businesses, of which 44,766 reported less than $250,000 in gross receipts.[1] Fifty-two businesses reported over $50 million in gross receipts.

In July 2021, members of the Oakland City Council brought forward a proposal to establish a progressive gross receipts business tax. The proposal failed to pass, but at the same meeting the council established the Blue Ribbon Equitable Business Tax Task Force to develop recommendations for a modernized, progressive business tax. The 11-member task force consisted of nine members of the business community, one representative from labor and one workforce development representative.

After a seven-month process, the Blue Ribbon Task Force issued recommendations for a new gross receipts tax policy, with a tiered approach that would charge larger businesses more and separate out businesses by industry type. At the same time, three more proposals for establishing progressive business taxes were put forward, one by two City Council members, another by a coalition of unions and community organizations, and the third by a coalition of larger businesses. The total annual revenue projected under each proposed tax ranged from $10 million to more than $30 million. This measure is a compromise of the four competing proposals that was negotiated by councilors, large and small business owners, union members, and advocates.

The Progressive and Equitable Business Tax is the result of that negotiated agreement. It would set lower taxes on larger businesses than the more progressive proposals would have, but it is projected to raise more than $20 million annually in revenue and would lower taxes or maintain the same rate for the vast majority of businesses.

This measure requires a simple majority (50% plus one vote) to pass.

Measure T's proposed progressive tax system would not impact, or would provide minor tax relief to, the vast majority of Oakland’s businesses, especially small businesses affected by COVID-19. The majority of businesses in the city are very small (93% have gross receipts of less than $1 million),[2] and many of those businesses are owned and operated by people of color. Those businesses would either receive a tax cut or maintain their current tax rate. Businesses with the largest revenues would see tax increases, but the scale would be along the lines of an increase from $0.60 per $1,000 in gross receipts to $2.50 per $1,000, amounts that are manageable for large and successful businesses. Two categories of businesses would see an increase of $1.20 per $1,000 to $5.50 per $1,000. These increases are likely to remain affordable for the largest businesses. The rates would also vary by industry and have been designed to levy higher burdens on business types considered to be the most profitable.

In addition, Measure T would provide tax incentives for construction companies that use an apprenticeship model and provide health insurance to their workers. Apprenticeship programs help lower-income people and people of color break into higher-paying construction jobs, and the guarantee of health insurance would help low-income residents to protect themselves against health problems and high health care costs.

Simply put, Oakland needs more tax revenue to meet the needs of its residents and to expand and improve city services. This measure promises to build a more progressive tax system in Oakland, raising vital revenue and providing minor tax relief to small businesses. By asking larger and wealthier businesses to pay more, Oakland could rely on revenue from healthier, more established businesses.

Any time taxes are raised on large employers, there is a chance that businesses will move away. In recent years, Oakland has become an appealing location to headquarter Bay Area businesses, with lower costs than San Francisco, and this measure could change that trend. However, the tax increase for the largest businesses would be relatively small. Even the highest rate for the largest businesses would be just $5.50 per $1,000 in gross receipts. Oakland’s location, population and culture would remain attractive reasons for opening a headquarters in the city.

Establishing a progressive tax system would improve the city’s financial footing and provide minor tax relief to small businesses, helping them operate in Oakland.

[1] Erin Roseman, “Fiscal, Economic and Administrative Impacts from Proposed Changes to Business Tax Structure,” memorandum, City of Oakland, May 25, 2022, https://cao-94612.s3.amazonaws.com/documents/BLT-Supplemental-Structure…..

[2] City of Oakland, “Progressive Business Tax Proposal,” last updated May 26, 2022, https://www.oaklandca.gov/resources/progressive-business-tax-proposal.