What it does

Proposition J is an ordinance that makes three changes affecting San Francisco's "transient occupancy tax" (hotel tax):

- Imposes a 2 percentage point increase on San Francisco's hotel tax from Jan. 1, 2011, through Jan. 1, 2014. The current rate is 14 percent plus a 1 percent to 1.5 percent Tourism Improvement District assessment fee. If this measure passes, the new hotel tax plus the Tourism Assessment rate will be between 17 percent and 17.5 percent.

- Clarifies that the hotel tax is charged on the full retail rate of the hotel room. For example, if the hotel room costs $100 per night to the traveler, the new 17.5 percent tax and tourism assessment fee would be $17.50, for a total price of $117.50. If the traveler bought the hotel room online, it is possible that the online travel company bought the room at a wholesale rate from the hotel, at perhaps $90, and is charging hotel tax on only the $90, not the $10 in additional revenue to the online travel company. This measure would close that loophole to require the tax to apply to the full price.

- Clarifies the exemption to the hotel tax on extended hotel stays. This is a clarification of the code's "permanent resident" exemption from the tax. The tax has always included a permanent resident exemption to ensure that low-income people living in residential hotels would not be required to pay the tax. However, under certain circumstances current law authorized corporations and business entities to claim the exemption, and lawsuits have been initiated over these claims. Airlines sometimes have booked hotel rooms for more than 30 days, to accommodate flight crews who stay overnight. Although the individual members of the crews did not stay for the entire period the room was booked, the airlines claimed the exemption because the room itself was booked more than 30 days. Prop. J changes the definition of a permanent resident from "any occupant" to "an individual" to remove any basis for corporations and business entities to claim a tax exemption meant to benefit low-income people living in residential hotels.

Several portions of this measure are identical to another measure on this ballot, Prop. K, a measure introduced by the mayor. But the measures differ in important ways. First, while the mayor's measure includes the provisions to apply the tax on the full retail rate and to limit exemptions to low-income residential hotels, it does not include the temporary 2-point increase in the hotel tax. Second, the mayor's measure includes a provision that would invalidate Prop. J if Prop. K receives more votes. That means that if both measures pass but the mayor's measure receives more votes, the 2-point increase would not occur but the code clarification provisions would remain.

Why it's on the ballot

Prop. J is an initiative ordinance that made it to the ballot as part of a signature-gathering effort funded by a coalition of labor unions. It is part of a series of revenue measures that were proposed for the ballot in part to reduce current and projected budget deficits.

In addition, the measure is part of a City effort to close loopholes in the hotel tax. The City previously has attempted to collect the hotel tax on the retail rate charged by online travel companies for stays in San Francisco hotels that are booked online. Online travel companies believe they are not required to remit this tax to the City and sometimes keep the tax that would be charged on the difference between the retail rate and the wholesale rate. While this disagreement is being decided in court, passing a ballot measure clarifying the tax agreement would eliminate ambiguity in the future. This amendment clarifies that the full retail amount of the booking is subject to the tax, regardless of who the sales agent is.

Because it is an expansion of the use of an existing tax, it must be passed by a simple majority of the voters. Because the ordinance affects the application of a tax, it cannot be changed by the Board of Supervisors and must be referred to the people.

Pros

- This measure would help balance the City budget. The tax increase could bring in an estimated $23 million annually to the General Fund. Closing the loopholes could bring in an additional estimated $7 million annually. To the extent that the new revenue is used to fund existing programs and not new ones funded through the General Fund, it would help reduce the City's structural deficit. This reduction in the deficit could result in an improvement in the City's credit rating, which would lower the cost of borrowing and save the City money.

- This measure levels the playing field across hotels and means of room reservations by making all forms of hotel room purchase subject to the same tax.

Cons

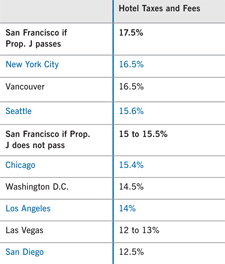

- This measure would harm San Francisco's tourism competitiveness relative to other cities. If approved, this measure would result in San Francisco's 17.5 percent hotel taxes and fees being the highest in the country among comparable destinations. For example, the hotel tax is 14 percent in Los Angeles, 12.5 percent in San Diego and 16.5 percent New York City.

- This measure sacrifices the competitiveness of the hotel industry in order to save City worker jobs. Because the average City worker is far better compensated than the average hotel worker, this measure could indirectly harm lower income workers should the tax increase lead to a loss of employment in the hospitality industry.

- The portion of the measure dealing with Internet bookings does not provide sufficient information for how to collect the tax. Instead, it continues to leave too much ambiguity in the roles of the seller (booking company) and service provider (the hotel).

SPUR's analysis

SPUR is opposed to this measure for three main reasons. First, the case has not been made that the General Fund needs to grow. This really may be a time when we need to solve our structural budget deficit by cutting back. Second, we think this is a case in which the tax would start to make San Francisco uncompetitive. It seems hard to justify having a higher rate than New York's. Third, there is a history in San Francisco of using most of the proceeds of the hotel tax for purposes that generate economic activity. This measure's commitment of the proceeds to the General Fund sets a precedent of utilizing the tax for public objectives that may be important but do not clearly generate additional economic activity.

SPUR recommends a "No" vote on Prop. J.