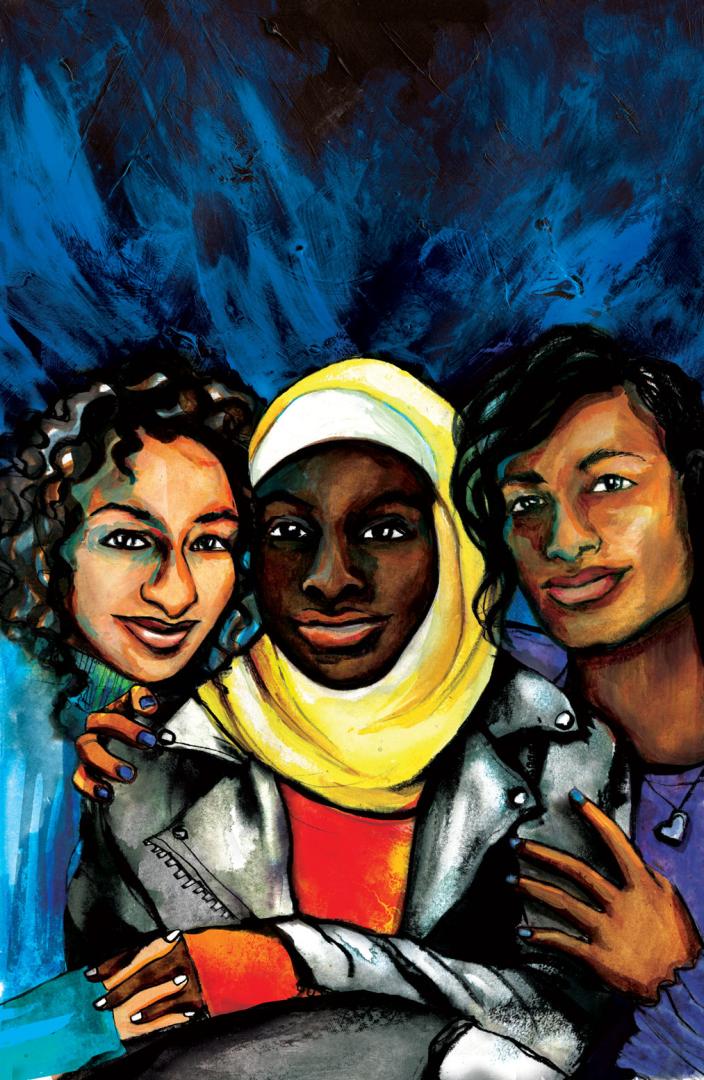

We invite you to reimagine a Bay Area where we close the racial wealth and well-being gap.

Imagine a Bay Area where economic opportunity is accessible to all people and the social safety net is strong enough to meet basic needs. The small but unpredictable events of life — a sick child, a parking ticket — do not swell to become undue financial burdens. We no longer expect poverty to be intergenerational. Instead, we address the economic impacts of systemic racism head-on, so that poverty, homelessness and hunger are rare and episodic, not a permanent way of life.

We invest in high-quality community services — like education, transit, parks and libraries — knowing that they are essential for economic security. As we work courageously and intentionally to close the racial wealth gap, more people become active in the economy, and the economy continues to grow.

Artwork: Leah Nichols

Let’s create policies that help bring opportunities for prosperity to all people of the Bay Area.

Historically marginalized communities lack adequate access to the resources needed to thrive. Access to high-quality jobs, schools, fresh food, clean air and water, open space and more are often severely limited in communities with low incomes, in predominantly Black and Latinx neighborhoods, and where older adults and people with different abilities can afford to live. In order to make the Bay Area a place that works for all residents, we need to close the racial wealth gap through policies that support the ability of people to thrive in their communities.

We have to start by making sure that our shared public services are excellent and available to everyone.

Everyone deserves to have equal access to high-quality public services and opportunities. Investing in our shared resources, such as libraries, parks and transit, will help remove burdens and meet needs, laying a path to greater economic security across the board. We can build a system of public goods that reaches all people, regardless of their income or neighborhood, and allows people to share in the vast wealth of our region.

Artwork: Ryan Floyd Johnson

Public assistance should work so that everyone in the region can feed their families, pay their bills and become economically secure.

Traditional social welfare programs don’t help people fix a broken car, pay an electric bill or buy clothes for a job interview. Programs that give individuals or households money with no specific requirements on how it is spent can help fill these gaps. At the same time, California’s public benefits systems do not reach every eligible person, with some programs missing over a million people who qualify. Ensuring that existing programs are easier to access is an important first step.

Artwork: Micah Bazant

What if we dramatically reduced the fines and fees that strip wealth from working and low-income people?

Fines and fees are often high-pain, low-gain tools that don’t meet their intended goals and can strip wealth from low-income and working families and communities. California has some of the most costly fines and fees in the nation, but they do little to change behavior like speeding or littering. Low-income people and people of color are more likely to be fined and more likely to struggle to pay fines,creating one of the biggest barriers to economic security and mobility. The Bay Area should look to alternative systems that can promote safety and social good without creating impediments to economic stability.

We can reimagine taxes so that everyone contributes equitably to supporting public services.

California’s complex and outdated property tax system fails to encourage new housing, benefits those who were able to achieve homeownership decades ago and does not generate enough funding for things we need the government to provide. Because property taxes in California remain artificially low, cities and counties look to sales taxes to pay for public goods. But sales taxes also play a role in reinforcing structural inequality. Every consumer pays the same tax rate at the register, but low-income households pay a higher percentage of their income because they have fewer resources to begin with. In order to create a fair tax system, California’s tax structure needs an overhaul.