What the Measure Would Do

Proposition S would allocate a portion of San Francisco’s hotel tax revenue, which currently goes into the city’s General Fund, to specific services that support the arts and homeless families. San Francisco imposes a 14 percent hotel tax (consisting of an 8 percent base tax and an additional 6 percent tax surcharge1 ) on the rental of hotel rooms.

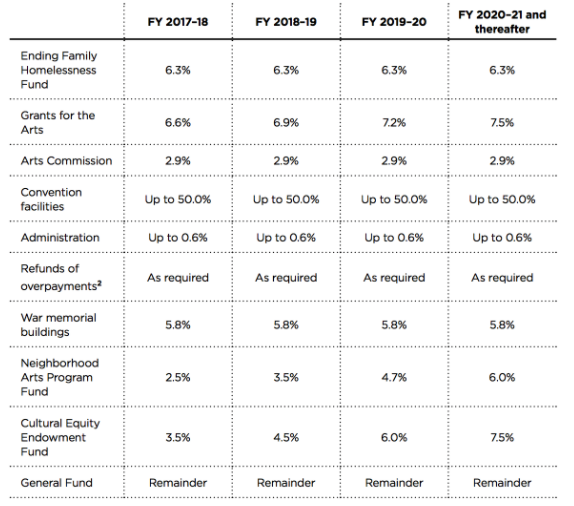

This tax generates approximately $440 million per year. Currently, much of this revenue is counted among the city’s discretionary revenue and contributes to determining baseline spending on a range of city services. Prop. S would require the Board of Supervisors to annually allocate the money raised by the base tax portion of the hotel tax for the purposes listed in the table at right. Funds raised by the base tax that are not allocated for any of the purposes below would go into the city’s General Fund.

This measure would establish several new funds, including an Ending Family Homelessness Fund, which would fund programs for homeless families and low-income families that are at risk of becoming homeless. This measure would also establish a Neighborhood Arts Program Fund, administered by the Arts Commission, to provide resources to nonprofit groups that offer affordable facilities for the arts. Prop. S would also create a Cultural Equity Endowment Fund to support arts organizations dedicated to the experiences of historically underserved communities.

The city currently allocates General Fund revenues to many of these same purposes. When compared to the current spending levels, funds allocated to the uses specified in Prop. S would grow by approximately $26 million in fiscal year 2017–18. By 2020–21, the increase over current spending would be approximately $56 million.3

How Prop. S Would Distribute Hotel Tax Revenues

The Backstory

San Francisco’s hotel tax was created in 1961 by then-mayor George Christopher, who argued that cultural facilities are needed in San Francisco in order to attract tourists. The tax rate was initially set at 6 percent and was increased incrementally to the current rate of 14 percent, established in August 1996. San Francisco has one of the highest hotel room tax rates in the nation.4 Until 2013, it was unique in that most of the revenue from this tax was dedicated specifically to arts organizations.

Legislation passed in 1974 allocated funding from San Francisco’s hotel tax to arts programs and low-income housing in the Yerba Buena Redevelopment Area. During economic downturns in the 2000s, the hotel tax was repeatedly amended to distribute funding to other programs, and in June 2013 the Board of Supervisors removed the allocation to arts programs and dedicated 50 percent to the Moscone Convention Center and 50 percent to the General Fund.

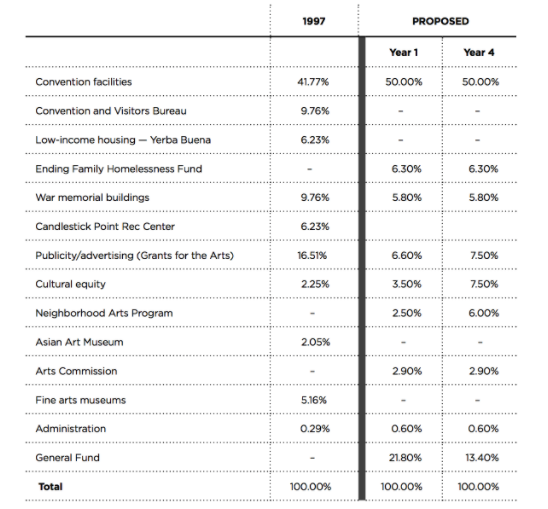

The hotel base tax generated approximately $12.4 million in revenue in 1997. Last year, the hotel base tax generated approximately $31 million in revenue. A comparison of the hotel tax in 1997 with the proposed allocations of Prop S. shows that many arts programs would receive a lower percentage of funding than they received in 1997, but this would still result in larger appropriations than they received in recent years.

This measure qualified for the ballot through a signature-collection campaign led by a coalition of arts and homelessness organizations. As a dedicated tax, it requires the approval of two-thirds of voters to pass.

Hotel Tax Distribution Percentages

Pros

-

The hotel tax was created to promote activities that bring tourists to San Francisco. The arts continue to be a defining element of the city that draws visitors from around the world, and the revenue source for this set-aside would be closely — and appropriately — tied to its expenditure purpose.

-

The percentage of hotel tax revenue that the measure would allocate to arts programs is reasonable (in some cases less than the same programs were receiving in the late 1990s).

-

The city has a crisis of homelessness that affects both residents and visitors. Additional dedicated funding would make it possible to fund more services and generate additional housing that can be offered to homeless families.

Cons

-

The city has recently undertaken an effort to combine its homelessness programs and funding under one department. It’s more effective to fund these programs comprehensively rather than by piecemeal ballot measures.

-

Because of the way it’s structured, Prop. S would reduce the amount of General Fund revenue that would otherwise be allocated to existing setasides like Muni and the Children’s Fund. If the hotel tax does not grow as predicted, the measure would have an even greater impact on the discretionary pot for other city-funded programs.

-

Any future changes to Prop. S would require another vote at the ballot. It’s best to give the legislative budget process the flexibility to determine priorities for city funding year to year.