San Francisco charges a one-time transit impact fee on new office development in the downtown area. This fee is an important funding source for Muni. At the same time, it has not proven to be an impediment to development. This article recommends an expansion of the fee in four basic ways:

1. Apply the fee to new development citywide, not just in the downtown area.

2. Apply the fee to all types of commercial (non-residential) construction, not just office.

3. Revise the legal nexus argument to justify a higher fee.

4. Index the fee to inflation.

The article is based on a study completed by Nelson\ Nygaard Consulting Associates, who were hired by the Planning Departmentto undertake the city's first comprehensive analysis of the Transit Impact Development Fee (TIDF) since 1984.

Background

San Francisco is unique in the United States in having a development fee that is dedicated entirely to transit capital and operating costs.

The San Francisco Board of Supervisors established the current Transit Impact Development Fee in May 1981. Delineated in Chapter 38 of the San Francisco Administrative Code, TIDF was intended to recover the capital and operating costs of increased peak-period transit service associated with new office construction in downtown San Francisco. The law says,

The demand for public transit service from downtown area office uses imposes a unique burden on the Municipal Railway, qualitatively different than the burden imposed by other uses of property in San Francisco. The need for that level of service provided by the Municipal Railway during peak-periods can be attributed in substantial part to office uses of property in the downtown area.

The Transit Impact Development Fee attempts to recover the cost of carrying additional employees into downtown via public transit, capturing fees on office development on a square foot basis at the time the development is occupied. The fee is intended to capture "all costs incurred by the Municipal Railway in meeting peak-period public transit service demands created by office uses in each new development subject to the fee, including the expansion of service capacity through the purchase of new rolling stock, the installation of new lines, the addition of existing lines and the long term operation, maintenance, repair and replacement of those expanded facilities."

The existing transit impact development fee applies only to new office development located in the greater downtown area (see Figure 1). TIDF does not apply to the many other land uses that operate downtown, including hotels, entertainment venues, and retail space.

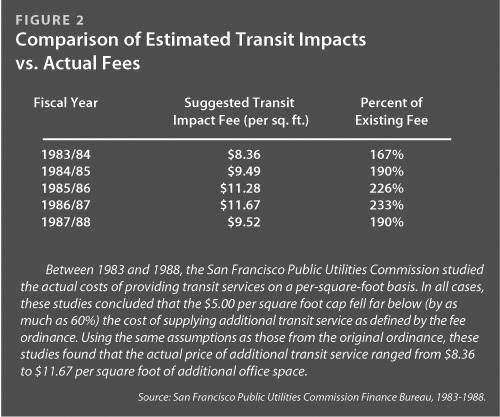

TIDF requires that downtown office developments pay the fee based on the number of gross square feet of office space added by the new development at the time the building is occupied. The fee is capped at a one-time payment not to exceed $5.00 per gross square foot. This "cap" amount is less than half the actual cost of serving these new developments (See Figure 2).

The use of fee revenues is limited by statute to cover the cost of additional peak period service into, through and within the greater downtown area, over and above the levels provided by Muni in 1981 (at the time the ordinance was passed). Incremental operating costs for expanded express bus service to downtown is an example of a project funded by the fee. Much of Muni's recent service expansion into SOMA is being funded with TIDF proceeds. Recent capital projects funded in part by TIDF revenues include studies for new yards and vehicle purchases.

Unfortunately, since 1981 other operating funds for transit service have diminished, making it difficult for Muni to maintain, much less enhance, service beyond 1981 levels. TIDF funds cannot be used to ?backfill? for the loss of other sources. Any expansion in peak service since 1981 has generally come from replacing lower capacity vehicles with higher capacity vehicles, such as replacing standard sized buses with articulated coaches. To justify TIDF expenditure, Muni looks at the amount of capacity (seats and standing room) operated downtown during peak periods. By using higher capacity vehicles, capacity may increase although costs go up very little.

Although the fund may be used for either capital or operating purposes, the fund has consistently been used primarily as an operating resource, as capital funds are easier to generate through grants and other sources.

Problems with the Current Fee

The existing fee fails to address current development patterns and Muni service needs adequately. Problems with the current fee include:

Limitation to Office Uses:

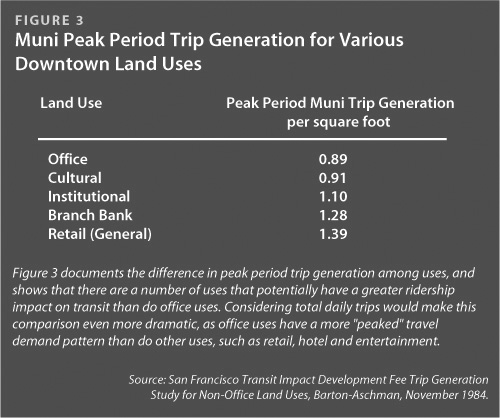

Many new developments that generate substantial transit demand legally escape TIDF. These include major retail and entertainment developments, hotels, institutions and cultural developments, and some business service and industrial uses that include office functions. A study conducted by the Public Utilities Commission in 1984 revealed that many of these land uses may generate as many, or more, peak period trips on Muni than does office space (see figure 3).

New Areas of Development:

Office uses have expanded beyond the downtown, creating a demand for transit service in new areas including but not limited to Potrero Hill, the Mission, and potentially Treasure Island, the Presidio and Hunters Point. It may actually be more expensive for Muni to provide service to these new employment concentrations than to downtown, where a density of service already exists.

Limitations on Spending:

The TIDF ordinance restricts operating funds to uses that increase peak-period service over 1981 levels. This hurts Muni as overall funding has diminished, making it difficult to maintain service, much less increase it beyond these levels. Funding is necessary both to maintain and expand service levels, and to provide higher quality service, which will ultimately result in increased ridership and transit mode share. Additionally, service expansion needs are not limited to the peak period. Although Muni may have vehicles available for night service, the incremental cost of providing more service hours is essentially the same whether the hour is provided at 9 AM or 9 PM, with the only variable being the capital cost of a new vehicle.

Conversion to Office Uses:

Many new office uses are conversions or reuses of other existing buildings classified under other land uses, such as warehouse and light industrial. While these should come under TIDF at the time they are converted, they can be difficult to track if they do not require extensive remodeling, and therefore do not need the same level of Department of Building Inspection involvement as new construction. A revised ordinance should be able to close this loophole either by adding non-office uses to the fee and/or broadening the definition of ?office uses.?

Potential for Refunds:

The fee is currently set up to collect, prior to occupancy, the incremental cost of providing transit service for a 45-year presumed building life. There is a provision allowing a developer to request a refund of a portion of their TIDF funds if the building is converted from office to another use. While there has been no such request to date, it is possible, for example, that an office development could convert to residential at some point and request a sizeable refund.

No Mechanism for Inflation Adjustments:

The current flat fee has never been revised and has no mechanism for adjusting for inflation. When originally applied in 1981, $5.00 per square foot represented over three months of rent on most of the properties covered by the fee. Today the fee is about one month of rent on Class A space.

Inattention to Quality of Transit Service:

The current fee addresses only the quantity of service Muni must provide to meet expanded demand. It does not address service quality, efficiency, effectiveness, or whether the added service is well utilized. Nor does the current ordinance address the proportional mode share attracted to transit ? i.e., is Muni carrying the same proportion of total trips after development is intensified and does the change in mode share have any additional impact on Muni? Muni may not use the fee to offset the costs of providing a higher quality of service, attracting more riders to transit (except through peak period service expansions) or providing added service in times of day other than the peak period. This is critical because in San Francisco, it is not possible to widen most streets. In this constrained system, the only way to add workforce (particularly downtown) is to increase the percentage of trips taken on transit. Attracting new riders to transit requires improvements to service quality as well as quantity.

The Real Impacts of Development

The impact of development on Muni is not limited to the number of peak period riders on the system. Increased development increases the total number of trips made by all modes, autos as well as transit, both within and outside of the peak. More travel results in increased competition for limited roadway space. As travel increases, congestion also increases. Congestion slows the travel speed along the street, impacting all modes. As Muni service is slowed, more resources are required to provide essentially the same level of service. Slowing travel speeds has the double impact of making transit less competitive with the automobile and requiring that Muni put more resources into existing services rather than expansion. For example, if a route takes one hour to operate and is offered every 10 minutes, six buses are required to provide that service. If, after congestion increases, it takes 80 minutes to make the same trip, then eight buses are required to offer the same 10 minute service. As development increases, money that might be used for enhancing service is first deviated into ?making up? for slower travel times and increased congestion. Demand for transit services may increase at any time of day, not just during the peak period. Although Muni may have enough vehicles in its fleet to cover service expansion outside of the peak, the operating cost of adding off-peak service is essentially the same as adding peak service, since driver hours are increased.

Measuring only service capacity, Muni has had some difficulty in showing increases in downtown service, as required to justify the spending of TIDF funds. Additional express service, implementation of the F-Line (Market Street trolleys) and the Muni Metro Extension (to Caltrain) have been obvious examples of service additions. However, the overall number of service hours provided in the greater downtown has not increased over the years that TIDF has been in place. To address this issue, Muni has revised the "peak period" from a two-hour to a three-hour period in the morning and afternoon. Muni's reporting compares service provided during this three-hour period against the service provided in a two-hour peak period in 1981 to "find" service increases that justify the expenditure of TIDF funds. This is not improper, but it does suggest the limitations of focusing on simple capacity increases as the sole measure of transit improvement.

A revised Transit Impact Development Fee, then, must give Muni the opportunity to recover the true costs of development on the provision of transit service. However, the fee may not be used to solve all transit deficits in the city, and must accurately reflect only the additional burden of providing service to new development, rather than being used to achieve an improved service standard.

Recommendations for an Improved TIDF

Muni is critical to many related land use issues being addressed by SPUR. Increasing housing availability and affordability, continuing economic growth and encouraging density can only be realized with a fully funded, fully functional and well utilized Muni system. Correcting the deficiencies in TIDF is only one necessary mechanism for improving Muni's funding situation, while more accurately recovering the costs of all types of development on the transit system.

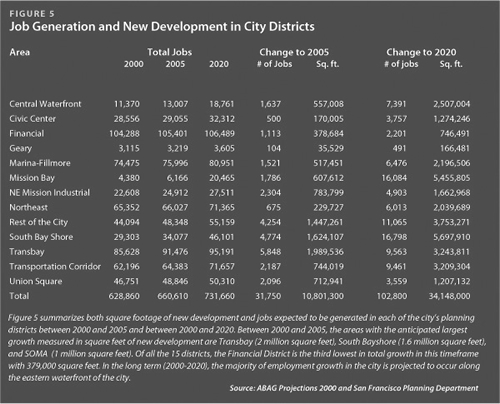

1. The Transit Impact Development Fee should not be limited to office uses, but should be expanded to include all types of commercial (non-residential) development. In fact, Planning Department projections show that office uses represent less than half of the square footage or number of jobs expected to be created in San Francisco over the next 20 years (see Figure 4).

While office development will have a significant impact on trip-making in San Francisco, it will not have an unusual or dominant impact. Limiting the fee to office uses has the further drawback of creating a "loophole" that encourages development to be classified in ways that avoid the fee. Applying the fee more broadly would eliminate this potential loophole, by requiring fees to be paid by all development in proportion to their impacts.

2. The Transit Impact Development Fee should be applied throughout the city. Transit service is impacted by development regardless of the location of the development. In fact, development outside of the downtown can be more expensive to serve because the service infrastructure is not already in place.

Expanding the TIDF boundary to the entire city would capture 100% of new development, and would eliminate the current "loophole" that allows development to avoid fees by locating outside of the fee boundary area. A city-wide fee is fully responsive to changing patterns of development, by charging new development wherever it occurs.

Applying the fee citywide would not encourage development in the neighborhoods. Employment-related development can only take place where the zoning allows. If the TIDF fee area is expanded, the fees will be imposed on the recommended land uses only in the areas zoned for these uses.

3. The legal nexus argument linking development with the impact fee should be revised. A critical component of the nexus analysis is the requirement that a development fee be used to cover only the incremental costs to the system created by new development. It is not legally possible to use a developer fee to bring a current "deficient" system up to a new "standard." For example, if ridership on Muni already exceeded capacity, development fees could not be used to increase capacity and bring the system into standard. The laws governing development fees require that developers be burdened only with the cost of maintaining existing service levels by covering the cost of their incremental burden. The cost of improving the system must be borne by other funding sources.

The existing TIDF is based on a very simple line of logic: more development generates more riders and more riders require increases in service. The logic of the current argument fails to take into account that Muni continually needs to put more revenue hours of service on the street simply to maintain schedules in light of increasing congestion. The current nexus argument also fails to recognize that Muni can only continue to add capacity over a fixed base if other funding sources are maintained. Given the poor funding picture for transit services in general since 1981, Muni has struggled to maintain, let alone expand, services in the downtown area.

A more compelling nexus argument for development fees is one that provides for a consistent relationship between the amount of services being provided and the intensity of development. This argument is typically used for fees covering other services such as parks and open space. In a park fee, for example, the city may identify the current coverage standard as ?X? acres of parkland/1000 residents. As the community grows, the ratio will be out of balance, and more parkland will be required.

Extending this logic to Muni services suggests that a constant relationship be developed between the amount of non-residential development in the city and the number of revenue service hours Muni provides. This coverage ratio concept is a court-tested, common approach to determining a minimum level for public services. This relationship can be expressed as the number of Muni revenue service hours provided divided by the number of trips generated by non-residential uses in the city. Using this approach, Muni will continually need to add services to maintain this relationship as development increases.

In its recent study for the San Francisco Planning Department, Nelson\ Nygaard calculated the current ratio between transit service and total trips generated by non-residential development. The current standard, presented in Figure 6, was derived from FY 2000 Muni recorded annual revenue hours, which were converted to average daily revenue hours. The estimated daily trips were derived by applying the trip rates identified in Figure 2 to the 2000 employment data provided by the Planning Department:

8,436 average daily revenue hours

divided by

9,035,282 estimated daily auto and transit trips

=

0.9336 hours

divided by

1,000 trips

this nexus argument, service hours could be added anywhere in the city (assuming a citywide fee) and in any time period necessary. Revenue hours could be added even if actual capacity were not increased, as more resources are needed to counteract slower travel speeds.

4. Three fee levels are recommended - $5.00, $10.00 and $25.00 per square foot, depending on the type of land use being constructed. The recommended fee structure would generate a total of $360.5 million for Muni over the next 20 years, compared with the current fee, which would generate only $76 million even if applied to office uses citywide, and $30 million if applied only to the current fee boundary.

5. Minimize the number of exemptions from TIDF. Currently, there are a number of exemptions from the fee, including developments by public agencies, which are exempt from real property tax, and development occurring within Redevelopment Areas, which are assessed on a case-by-case basis. There is no exemption based on the size of development. As TIDF is expanded to more uses and to the entire city, we believe it is important to implement an exemption for small projects (developments under 10,000 square feet) and for public buildings. However, the exemption for developments in Redevelopment Areas should not be retained, as this has resulted in some critical inequities. For example, new developments along the Embarcadero will not pay into the TIDF fund, despite the fact that they will receive excellent Muni service from the Metro Extension.

6. Limit the potential for refunds. Typically, land uses in San Francisco tend to convert from uses of less intensity to uses with increasing intensity. In the current fee, developers who are intensifying a land use that has already paid into the fee are required to pay the marginal additional fee resulting from their increased impact on Muni. It is recommended that this provision be continued in the revised fee, ensuring that current impacts are covered when land uses change.

Should a use be converted to one involving less intensity, the city could be liable for at least a partial refund. The current fee allows for a partial refund for the full 45-year life of a new office building. The cumulative impact of the conversion of a major office project to housing, for example, would require that Muni return a large proportion of the collected fee.

This possible future refund will not make additional development ?pencil-out,? as its net present value to a developer will be nothing. But it could needlessly hurt Muni. The refund provision should be eliminated.

7. Index the fee to inflation. The current TIDF has not been increased since it was implemented more than 20 years ago, and there is no provision for automatic indexing. An improved fee would include the necessary language so that it can be increased (or decreased) according to an established inflation index. Potential indices for the inflation factor include the Bay Area Cost of Living Index, Bay Area Transportation Index, Bay Area Construction Index or other local inflation factor. Once established by ordinance, the adjustment would occur annually and would not require additional action.

Conclusion

A fully functioning and well-used Muni system is critical to San Francisco. As development occurs, new burdens are placed on the transit system that should be offset by a Transit Impact Development Fee. While this is not the only funding source that should be looked at, TIDF should be revised to reflect the reality of development trends while retaining flexibility for the future.

Development is good for the city, but only when it is well planned and only when it is accompanied by the necessary infrastructure investments to accommodate the growth. A rationalized, city-wide TIDF, along the lines discussed in this report, will not negatively impact development. As long as the rules are clearly understood up-front, the costs are factored into a project's pro-forma, just like any other cost. We believe, in fact, that supporting an expanded TIDF is in the interest of developers, in the interest of business, and the interest of the city as a whole. In order to have responsible growth, the city needs to fund transit expansion. The TIDF is part of the answer.